January 5, 2023 in Deposit Accounts

4 digital features that power deposit growth

Speedy onboarding, ease of use, relevance, and instant access to help can all make a difference in deposit account experiences.

Key Takeaways

-

The typical onboarding process today is interrupted, not omni-channel, and built on top of legacy infrastructure. Due to these limitations, the average conversion rate for consumers who start an application and complete it online can be as low as 30%.

-

The best way to build an effective deposit account solution that drives conversion is to focus on speedy onboarding, ease of use, relevance, and instant access.

-

Blend’s best-in-class deposit account solution provides a more robust experience that allows more potential customers to self-serve deeper into the onboarding process, and allows financial institutions to get to the goal faster, with less effort.

Deposits are the entry point from which financial institutions can drive engagement and gain a bigger share of the customer’s wallet.

However, today’s increasingly competitive environment has resulted in a war for deposits. Customers now have the power and the confidence to consider these banking alternatives if their existing provider isn’t living up to expectations.

As a result, we’re not only seeing consumers across generations looking to digital-first firms to manage their financial lives, but we’re also seeing an increase in the number of people who hold multiple deposit accounts with a range of different providers.

With this in mind, it’s in a depository institution’s best interest to improve the deposit experience to win and keep customers. A best-in-class deposit account solution can help.

New digital-first firms are entering the fore, and customers now have the power and the confidence to consider these banking alternatives if their existing provider isn’t living up to expectations.

As a result, we’re not only seeing consumers across generations looking to digital-first firms to manage their financial lives, but we’re also seeing an increase in the number of people who hold multiple deposit accounts with a range of different providers. In fact, 40% of U.S. consumers transfer funds from accounts at incumbent national banks to accounts at other types of financial institutions each year.

With this in mind, it’s in a depository institution’s best interest to improve the deposit experience to win and keep customers. A best-in-class deposit account solution can help.

What makes an effective deposit account solution?

Here are four key features that contribute to an exceptional deposit account solution:

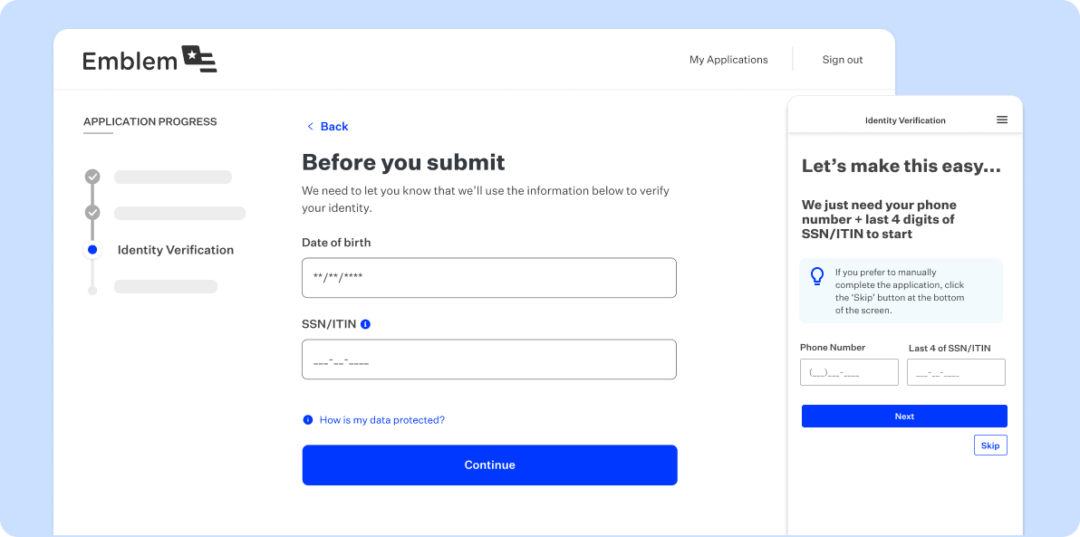

1) A speedy onboarding experience that improves speed and conversion

According to Deloitte, “a superior account opening experience can be vital for banks to remain competitive and to ensure loyalty.” And speed is crucial to an exceptional account opening experience.

Onboarding is where many traditional banks are falling short. The conversion rate for consumers who start an application and complete it online can be as low as 30%.

Easy single sign-on authentication and applications pre-filled with existing banking information can help deliver a better experience. Instant decisioning and automated verification can help too — and can help drive conversions. In fact, by using Blend’s software equipped with this functionality, some banks have seen up to an 85% submission rate for personal loans and over 80% submission rate for auto loans.

Blend Pre-fill: Leverage first and third party data sources to pre-fill application data, reducing time and keystrokes.

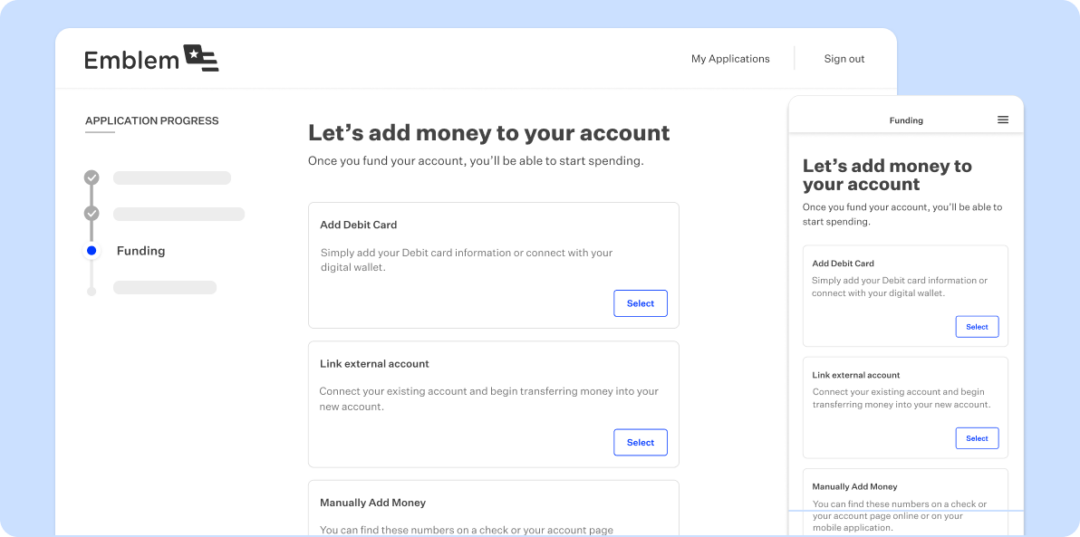

2) A user experience centered around convenience and ease of use

Convenience and ease of use are attractive to consumers — in fact, BAI research suggests that consumers value convenience ahead of both lower fees and better interest rates. In practice, banks can facilitate convenience by enabling consumers to open and manage their deposit account at times that suit them, through a range of channels. Consumers want to be able to intuitively navigate a website or application and input their information quickly. They value the ability to save their progress and pick up an application where they left off. They also expect an instant decision, which banks can provide through pre-approval.

Blend Funding Options: Multiple funding options including card funding, ACH, and manual ACH enables new customers to activate account for use in a single session

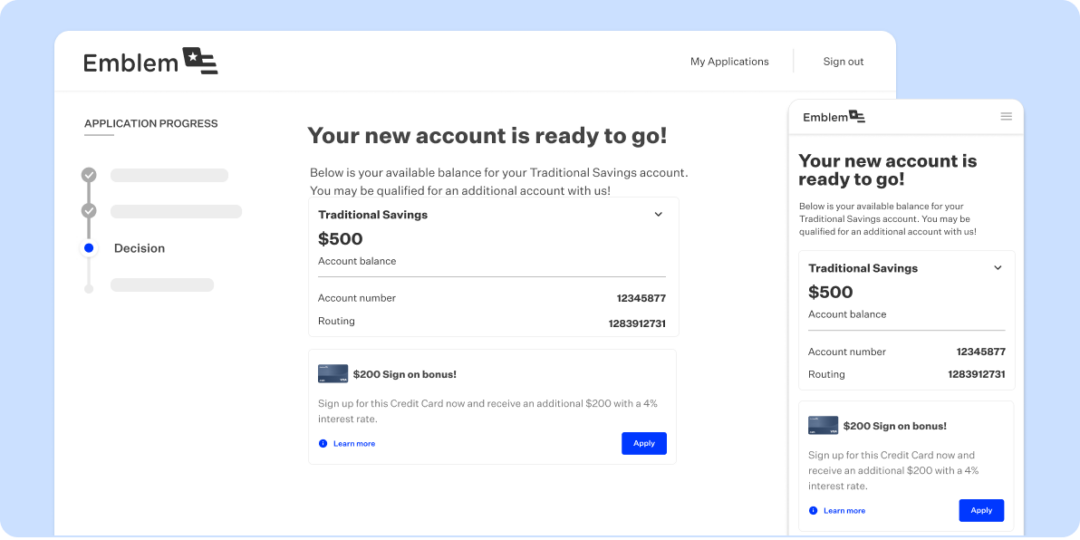

3) Personalized cross-sell offers that deepen relationships

By using intelligent insights, banks can make personalized recommendations that demonstrate an understanding of their customers’ needs. Leading digital banking teams cross-sell related products and services during the online application process.

Blend cross-sell: Deepen relationships in the moment of engagement by surfacing pre-qualified credit offers, or invitations to apply

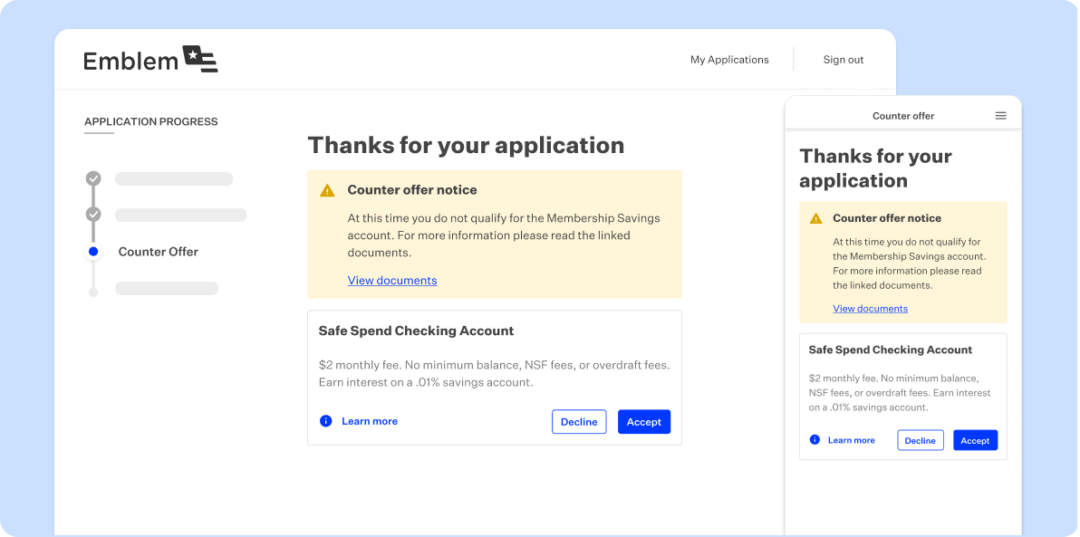

4) Instant access to help when it’s needed

Consumers want to feel reassured when making financial decisions. Great online banking experiences put users at ease and answer questions as they come up.

This doesn’t always have to come in the form of human support. A large majority of customers attempt to take care of matters themselves before reaching out to a live representative. Offering inline support or tips can assist in this process, but it’s also important to seamlessly hand customers over to an agent for more complex issues.

Blend counter offer: Help prospective customers find a suitable product by surfacing counter offers after criteria for a premium product request is not met

The unique benefits of Blend’s deposit account solution

Blend’s deposit account solution provides a robust experience that allows more potential customers to self-serve deeper into the onboarding process, allowing financial institutions to meet their business goals faster and with less effort.

It’s fast and secure

Financial institutions can pre-populate parts of the application with the information previously entered by their customer. This functionality, along with single sign-on authentication, guided borrower flows, automated identity verification, and instant decisioning, speeds up the application process.

It’s easy to use

Meanwhile, Blend’s user-friendly interface guides customers through applications in clear, easy-to-understand language. As the applicant inputs answers, their information is used to automatically update upcoming steps to help ensure questions are relevant.

It simplifies cross-sell with personalization

Blend also streamlines cross-selling. The insights gained in Blend from a deposit account application can help financial institutions make meaningful recommendations for other products based on the borrowers’ current financial situation and upcoming needs.

It offers the support customers want

Consumers are supported along the application process. Answers to common questions are built-in, and Blend Co-pilot helps loan officers provide real-time assistance when things get trickier.

It delivers tangible ROI to our customers

See how Landmark Credit Union’s change to the Blend deposit account application has saved Landmark employees over 9,000 manual hours of processing time, and also reduced the average time it takes to open a deposit account from 11 days to just 7 minutes.

Learn how BOK Financial collaborated with Blend to co-develop a customer-first solution using the Blend Builder platform to deliver impactful results in a fraction of the time and 72% of the cost for an in-house build.

Find out how Blend’s deposit accounts solution can help you realize these benefits

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.