April 26, 2023 in Composable origination

CBA live: Composability and the building blocks of a better future for financial services

Take a deep dive into Blend’s Instant Home Equity solution as Head of Blend Nima Ghamsari and Blend Solution Engineer Marc White demonstrate the power of low-code platforms and the future of composable origination.

Much of 2022 was marked by turmoil caused by a volatile housing market. And although we’re still grappling with that volatility in 2023, there has been one bright spot: home equity lending.

The confluence of fundamental changes in the way Americans work, long-term patterns of increasing home values, and challenging economic conditions has created a strong market for home equity products — with approximately $11T in untapped equity across the nation.

Recently, Head of Blend Nima Ghamsari and Blend Solutions Engineer Marc White spent time discussing and exploring the home equity lending space, which is proving to be critical to the current economic climate as it rapidly evolves, and how a low-code composable origination platform is the key to providing lightning fast financial solutions across all product lines.

The state of home equity

Although home equity lines of credit increased by 41% in 2022, which is admittedly a huge jump, Ghamsari was quick to point out that home equity is still barely being tapped by consumers across the country.

More people are working from home and desiring more accommodating workspaces. But with housing inventory being historically low, and mortgage rates being so high, the average homeowner is finding it difficult to change homes. As a result, more people are looking to remodel their current spaces.

And given that economic factors, like surging inflation and accompanying debt, are becoming more of a concern for American consumers, many people are looking to consolidate and simplify their finances. So why aren’t they taking advantage of the home equity they have, and instead, are turning to more expensive options like credit cards or personal loans?

The current home equity process is broken — we want to fix it

Well, the current home equity process is outdated, opaque, and costs thousands of dollars to complete. This is discouraging for consumers who need quick access to cash.

Plus, as Ghamsari pointed out, a traditional HELOC origination takes over 45 days. And all because many lenders are still using a document-heavy, outdated process.

There is a better way: Blend Instant Home Equity. It takes advantage of the latest technological advancements, resulting in a highly automated HE lending solution that allows you to:

- Close in days, not weeks

- Improve conversion rate through a personalized, omnichannel customer experience that requires very little manual intervention while leveraging instant verifications for immediate decisioning

- Lower operational costs by removing many of the manual aspects and automating initial and final decisions

- Increase utilization by incorporating in-app debt consolidation

Ghamsari then introduced Marc White to show how he’s been working with banks to help them solve these issues by using Instant Home Equity.

Seeing is believing

During his product demonstration, White spoke to how HE products are often treated similarly to standard, closed-end mortgage products. Meaning long turnaround times and laborious verification processes. But, as White maintained, accessing home equity should be no more challenging for consumers than any other type of banking product.

Blend’s Instant Home Equity solution takes the traditionally 30-step process down to about three, from application to funding. In turn, automating those core steps helps reduce processing times.

Ghamsari was quick to point out that the digital experience IHE enables is great, but it’s also important to recognize what’s happening under the hood. All of the verifications and integration points that are powering the experience are also reusable across all Blend products through the Blend platform.

Technology, like the Blend Platform, makes it possible to completely reimagine how lenders interact with their customers across all origination channels. In just moments, Bailey (in the demo), was able to receive a validated pre-approval, while behind the scenes automated workflows for income verification, AVM, title verification and insurance, created an application package that was essentially one Property Condition Report away from final approval and closing.

When lenders start trading their documents for data, they can do more things instantly for their customers. And that makes it easier for consumers to access products, like home equity, that can in turn allow them to pay down debt with lower monthly payments or finally remodel their home to fit their work space and lifestyle.

Build better, build faster: the future of banking

Ghamsari explained how Blend was able to create this IHE solution in just a few months.

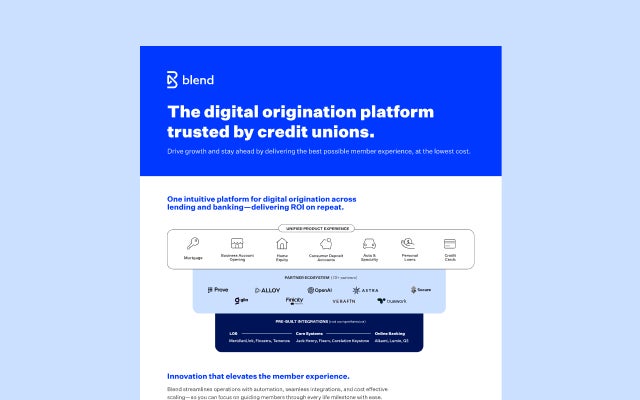

Throughout the years, as Blend has been serving financial institutions across every product line, similarities between mortgage, home equity, deposit account opening, small business lending, personal loans, credit cards began surfacing. And that’s when Blend realized they were all a combination of the same components: identity, income verification, asset verification, credit, decisioning, property verification, closing — just to name a few.

Ghamsari then went on to introduce Blend Builder: the first composable origination platform for banking products. Blend built Instant Home Equity using the low code, drag-and-drop work space, which was why it was able to come to life in just a few months, instead of years.

White’s demonstration highlighted several key features of the Blend Builder Platform, like numerous pre-configured blocks that are a native part of Builder’s library. The blocks contain complete workflows, integrations, and all of the logic for handling various customer interactions.

Composable origination provides you with the end-to-end and drag-and-drop tools that will allow you to build a better future for your bank.

Does your team want to reach financial innovation faster than ever thought possible?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.