May 18, 2022 in Challenges and solutions

How cloud banking software unlocks efficiency

Employees across financial services organizations do not have to rely on complex IT infrastructures to work effectively.

Traditional banking technology is renowned for being slow, inflexible, and costly, which could be why cloud banking software is rising in popularity. Using the power of the cloud, financial institutions can deliver secure banking services from anywhere, any time, and through any device with an internet connection.

New insights, unlocked.

Subscribe for industry trends, product updates, and much more.

It’s proving to be an appealing proposition. Almost three-quarters (72%) of IT executives in the banking industry say that including the cloud in their institution’s products and services will help them to achieve their business priorities.

One of the reasons cloud banking software is popular may be the efficiencies bank staff seek to gain by using it. Let’s explore three hypothetical examples that demonstrate how this technology can unlock efficiency for employees across a financial services organization.

Reducing costs and simplifying tech for IT personnel

Cecilia is an IT manager for a multinational bank. With the support of a team of software managers, Cecilia maintains a complex IT infrastructure that includes layers of new solutions to meet changing customer needs.

Over time, Cecilia has found it difficult and frustrating to adapt to new market changes and manage a growing number of integrations with different providers. As a result, she decided to embrace the cloud.

Now, with cloud banking software, Cecilia works with a single piece of technology from a provider that manages many of the integrations on her behalf. Her IT team is much more efficient — they can test quickly, get rapid access to new features as they are developed, and take products to market much faster than in the past.

Helping bankers deliver better customer service

As a banker at a bank branch, Samir has watched consumer expectations evolve over the past decade. He knows that meeting these expectations requires that he not only deliver more personal service, but also makes life as easy as possible for borrowers.

Samir can achieve both with cloud banking software. Using a single, unified solution, Samir has access to all the information he needs about his customers in one place. For example, one of his customers has just taken out a mortgage. When the customer enters the branch, Samir knows to ask about the new house. With this knowledge, he can also offer a special rate on a home equity loan so that the customer can buy the fancy new sofa they want. He can also e-mail the customer a link to the loan application, which has already been pre-filled with the information the customer has provided in the past.

The result? Not only can Samir provide his customers with a much better and faster experience, he can also spend much less time searching for information about his customers and walking them through the application process. He has time to support more complex customer needs, creating memorable and personalized experiences that lead to greater satisfaction and loyalty.

Untethering loan officers so they can work from anywhere

As a loan officer for nearly 20 years, Max has used a variety of disparate software solutions. He couldn’t always find the data he needed, and the data he could find was usually out of date. This was Max’s normal day-to-day life until he started using cloud banking software.

With mobile access to all of the information he needs in a single cloud-based platform, Max can work from anywhere — whether that’s his local coffee shop or from the comfort of his own home. He can be confident that all the data he is looking at is up to date and in real time. This makes Max far more efficient and more responsive to his clients. Not only can he build stronger relationships, he can also comfortably handle a higher volume of loans.

The efficiency benefits of Blend’s cloud banking software

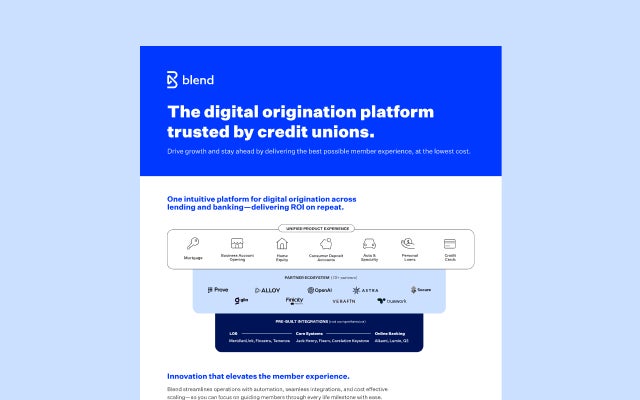

Blend’s cloud based digital banking platform is built to deliver efficiency benefits to everyone who uses it — whether that’s the IT team, customer service agents, customer, or loan officer.

- IT teams get constant access to the latest banking software and a wide range of pre-built integrations so they don’t have to start from scratch when launching a product.

- Customer service agents benefit from having a pick-up-and-go approach to the application. From the same easy-to-use interface, agents can start an application in-branch or online and let the customer finish it on their own time.

- Loan officers benefit from anywhere, anytime access to all the information they need, improving their efficiency, shortening the loan cycle, and increasing loan closings.

- Consumers get a consistent application experience across products and channels, supported by guided application flows, responsive design, and data pre-fill.

Ready to learn more?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.