March 11, 2025 in Consumer Banking Suite

Winning the race for deposits: 5 essential features for Credit Unions

Key deposit account features to drive growth and stay competitive in the digital age.

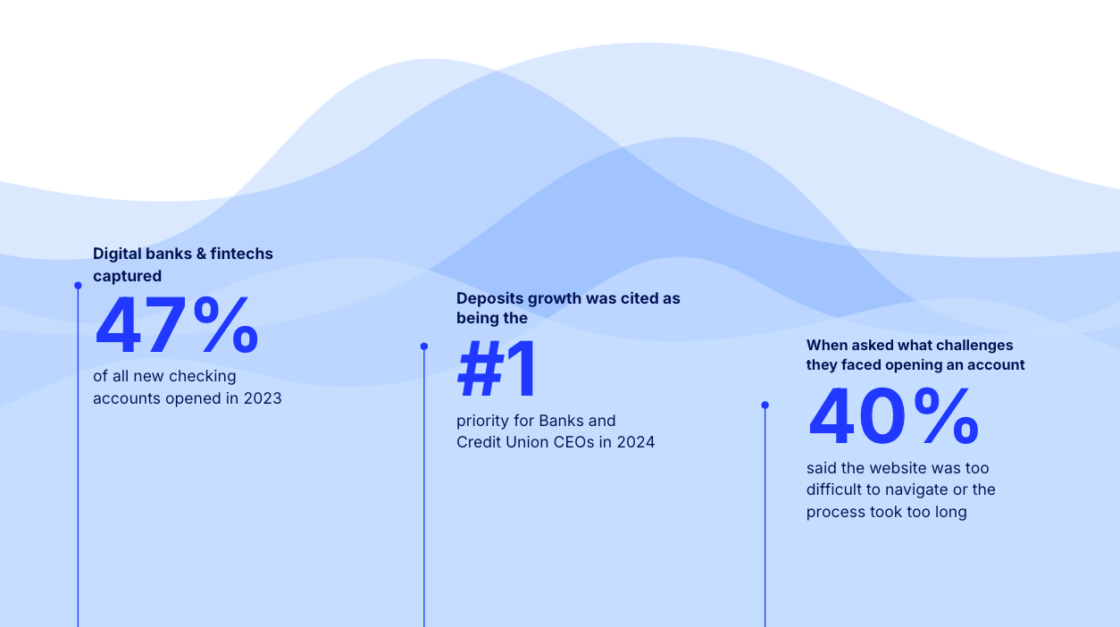

The fight for deposits has never been more competitive.

According to a 2024 study, 77% of credit union CEOs cited growing deposits ranked as their top priority.

At the same time, competition from fintechs and challenger banks is becoming an even bigger concern—47% of executives now view them as a major threat, and that number is only growing.

And it’s not just about competition—it’s about the experience. When asked about challenges consumers face in opening a deposit account, 40% of executives cited issues with website navigation or a process that simply takes too long.

We hear it all the time—outdated deposit technology is making it harder for financial institutions to deliver the seamless, modern experience consumers expect.

Deposit Account openings: A high friction experience

So, what’s causing these roadblocks?

For starters, a lot of the products consumers want don’t even have an online application. And when they do, the process is often clunky—forcing people to manually enter information on their phones, even when it could be pre-filled.

Then there’s the friction around verifying identity and funding the account. If something isn’t clear, customers reach out for help, only to find that the digital application and banker workspace aren’t connected—leaving them stuck, sometimes having to start over.

And when the experience falls short, it’s not just frustrating—it directly impacts the bottom line. On average, we found that it can take more than three days to complete an account opening, leading to over 50% of applicants abandoning the process before finishing. And every lost applicant isn’t just a missed opportunity—it’s $400-$700 in wasted acquisition costs.

Must-have Deposit Account features for Credit Unions

The good news? It doesn’t have to be this way.

With the right tools and technology, credit unions can remove friction, speed up account openings, and create a seamless experience that keeps consumers engaged.

The best deposit experiences don’t just open accounts—they build relationships, remove friction, and make it easy for consumers to take action. To stay competitive, credit unions need a seamless, modern experience that drives deposits and deepens engagement.

Here are the 5 must-have features that make a difference:

- Multi-account funding – Consumers should be able to fund multiple accounts from different sources without extra steps or delays. Forcing transfers between accounts just to complete funding creates unnecessary friction.

- Pre-approval and cross-sell capabilities – Personalized, data-driven offers can help deepen member relationships and increase product adoption. Using existing customer data to present relevant offers makes the experience more engaging and valuable.

- Omnichannel Banker Workspace – A seamless experience across online, in-branch, and mobile ensures that consumers don’t have to restart applications or deal with disconnected systems when they need support.

- Unified platform – A single, integrated experience for deposits, credit cards, personal loans, auto loans, and more creates efficiency and makes it easier for members to manage multiple financial needs in one place.

- AI-powered decisioning – Automated pre-approvals and smart decisioning speed up onboarding, reduce risk, and eliminate bottlenecks that slow down account openings.

These features aren’t just nice to have—they’re essential for credit unions looking to improve member experience, reduce abandonment, and stay ahead in a rapidly evolving financial landscape.

Transforming your deposit growth with Blend

With Blend’s Deposit Accounts solution, credit unions can offer an intuitive, high-converting deposit experience that removes barriers and keeps consumers engaged from the first click to funding—and beyond. Ready to elevate your deposit strategy?

See how Blend can help you drive growth and deliver a seamless member experience

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.