March 31, 2021 in Consumer Banking Suite

Aligning your personal loans strategy with customer expectations

New Blend research provides clues about how to top the market in providing digital-first personal loans service to meet consumers' needs.

Across every product line your business offers, you and your team undoubtedly work to deliver products that align with what consumers are looking for. The aim? Trying to win over customers by first determining the latest expectations and subsequently matching your lending products with your findings.

Competition for personal loans is stiff. In 2020, 39.8% of personal loans taken out by Generation Z and Millennials were issued by fintech lenders, compared with 28% issued by traditional banks. As you formulate your strategy for capturing borrowers, show them you can deliver best-in-class experiences, meeting the expectations set by fintech market entrants.

We’ve done the legwork to begin figuring out what customers care about when it comes to choosing a lender for personal loans, and we’re letting you in on our findings, so you can craft a strategy in line with what matters most.

What matters to personal loans borrowers?

Blend recently conducted a survey of 657 consumers who currently have a personal loan. The survey found that, to consumers, rate, speed, and simplicity were the most important factors.

Close to half of the respondents (46%) said they selected their lender because they offered the best rate. The same percentage of respondents reported selecting a lender because of the simple application process. And 32% chose a lender because they promised the quickest time to approval.

When looking at just those consumers who didn’t have a previous relationship with their lender, simplicity rose to the top of their list. This suggests that institutions looking not just to expand share of wallet but also attract new business should place a focus on developing a simple application process that eliminates friction for new borrowers.

Within the loan application process, borrowers surveyed marked the following as most important: speed of approval, receiving multiple loan structuring options (variations in amount, rate, and term), and an end-to-end digital process free from branch visits and mailing documents.

Meeting customer needs with Blend Personal Loans

Now that you know what matters to borrowers, what can you do about it? How can you leverage this information to develop a personal loans process that delivers on what borrowers value?

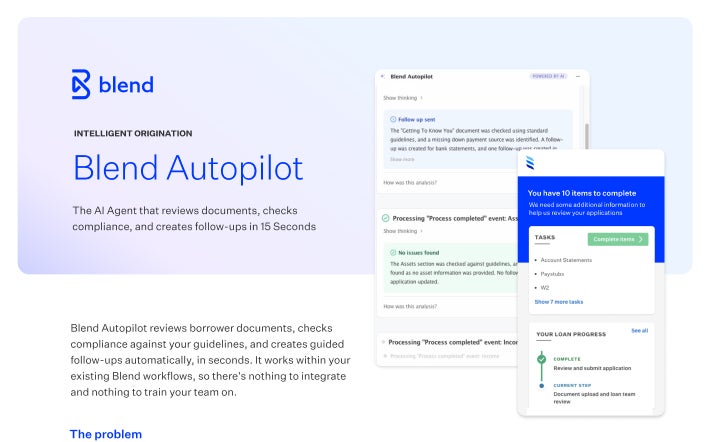

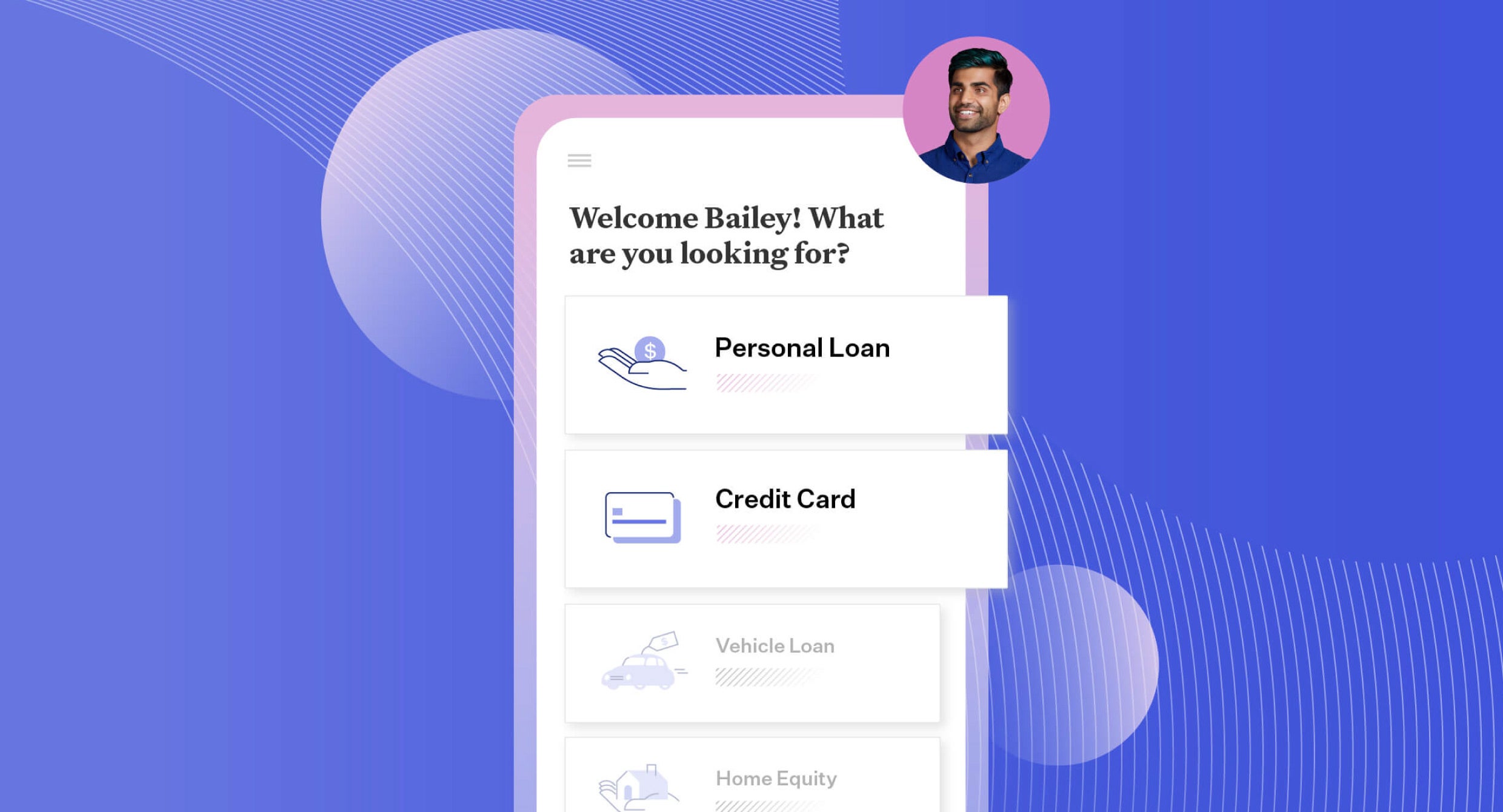

Blend Personal Loans, part of the Blend Consumer Banking Suite, can help you deliver on two of the most important factors in the application process for unsecured and secured personal loans, lines of credit, and overdraft protection lines: first, by providing a simple application process, and second, by giving you tools to offer a quick time to approval.

Deliver a simple personal loans application process

By implementing Blend Personal Loans, you can streamline the borrower journey from application to close. Leverage data pre-fill to eliminate the need for returning borrowers to manually enter personal information.

Help your lending teams guide borrowers throughout the process by using Blend Co-Pilot to follow along with the borrower as they complete the application. When questions arise, your support staff are enabled to provide support in a contextually-relevant manner. The full process takes place in one interface, including closing. Borrowers can e-sign in the same portal in which they applied.

This can be completed remotely — give your customers the luxury of avoiding unnecessary branch visits, phone calls, or paper mail sends. Enable consumers to apply from wherever they are, even the couch.

Offer a quick time to approval

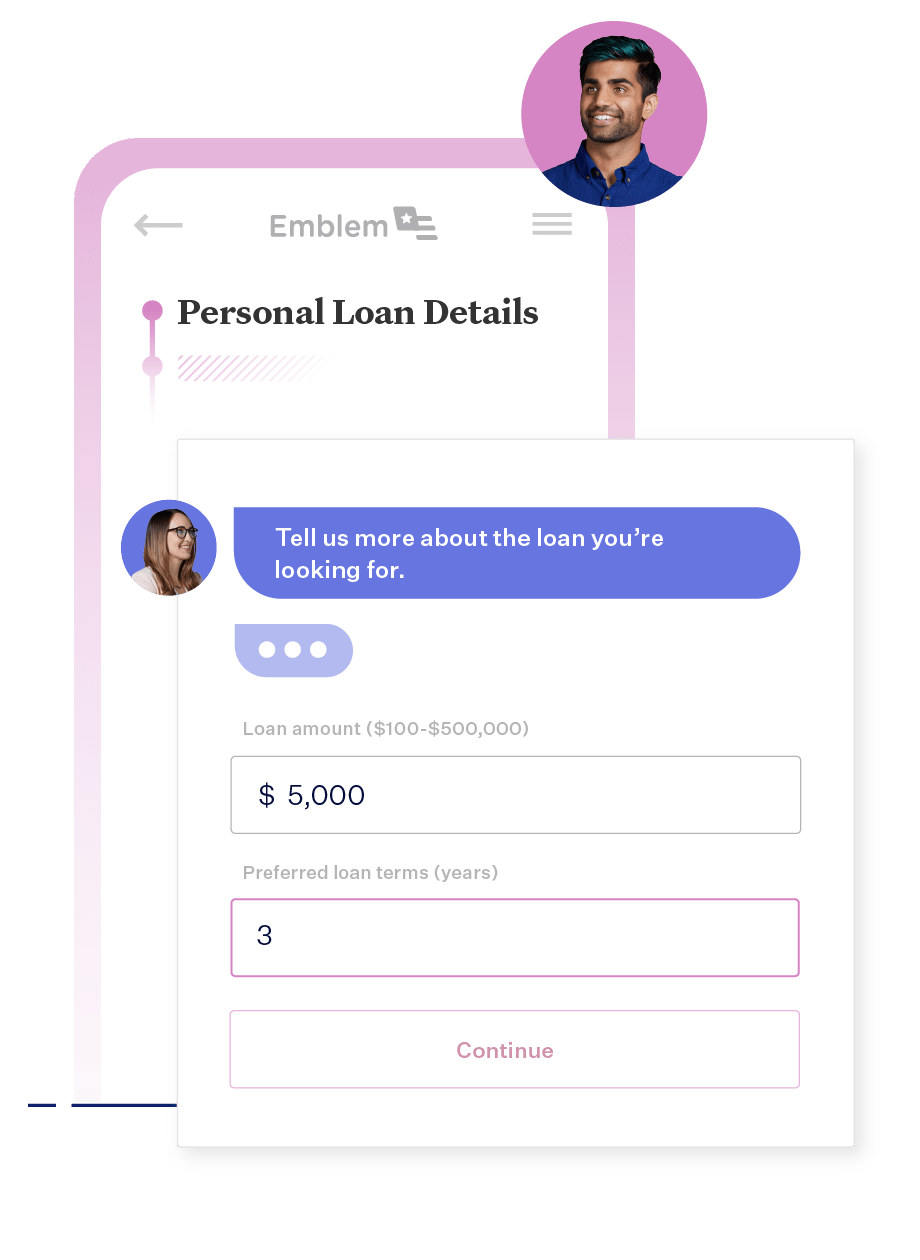

Blend enables you to empower your customers with fast access to buying power by automating manual processes. The automation of data verification, stipulation requests, and other time-consuming elements not only simplifies workflows for borrowers, but it also provides them with an approval sooner.

Blend integrates with your LOS so you can pre-approve customers in a single session. Provide an immediate feeling of progress to borrowers, then if the fit is right, disburse funds quickly after.

Crafting a customer-centric personal loans approach

Blend Personal Loans helps you capitalize on two of the most important customer priorities, but it doesn’t stop there.

Our survey also showed that borrowers value receiving multiple options for loan structuring. With Blend, loan officers can structure loans in seconds and help borrowers compare their options.

Whether you’re looking to capture borrowers you have a relationship with or hunt for new customers, honing in on borrowers’ latest priorities can help refine your strategy. Understanding consumers and how they make decisions helps you deliver the best-in-class experience your customers have come to expect at every touchpoint.

From bespoke research to product coverage, we have personal loans covered

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.