March 17, 2021 in Consumer Banking Suite

How top personal loan software supports a modern customer experience

Today’s borrowers expect a modern, fast, and seamless personal loan application process that matches the experiences of shopping or socializing online. And the right cloud banking solution can deliver.

The demand for personal loans is high as consumers search for the most cost-effective way to consolidate and pay off their debt.

As personal loan balances and demand increase, generational trends are emerging. In 2020, only 28% of personal loans issued by traditional banks were taken out by Generation Z and Millennials — compared to 39.8% issued by fintech lenders. Younger digital natives likely have high expectations when it comes to applying for a loan, prioritizing an experience that is fast and online.

In fact, according to McKinsey, “exceptional customer experience” is almost as critical as getting the “best rate.” Meanwhile, a recent FICO consumer study found that almost a third of customers would abandon an application process if forced to take action through a non-digital channel.

With this in mind, lenders have an opportunity to make a proactive change away from entrenched processes. It might sound daunting, but the right software and technology partner can help simplify and ease the transition.

How Blend’s personal loan software supports improved application experiences

Personal loan software can help lenders meet rising consumer expectations and deliver a low-effort, streamlined borrowing experience, from application to funding. The best solutions help manage many types of consumer lending products such as unsecured and secured personal loans, lines of credit, and overdraft protection lines.

Armed with this technology, lenders are seeking to not only drive higher digital conversions, but also compete in a saturated market. Strategies are being developed to empower customers with faster access to buying power by automating manual processes and serving their needs much more efficiently. Speedier processes can help lenders out, too — choosing an out-of-the-box solution can get personal loans products to market at a rapid pace.

Blend’s cloud banking platform streamlines the loan application process for personal loans, benefiting lenders and borrowers alike. It can help lenders to:

Automate parts of the personal loan process, supporting a streamlined experience for borrowers

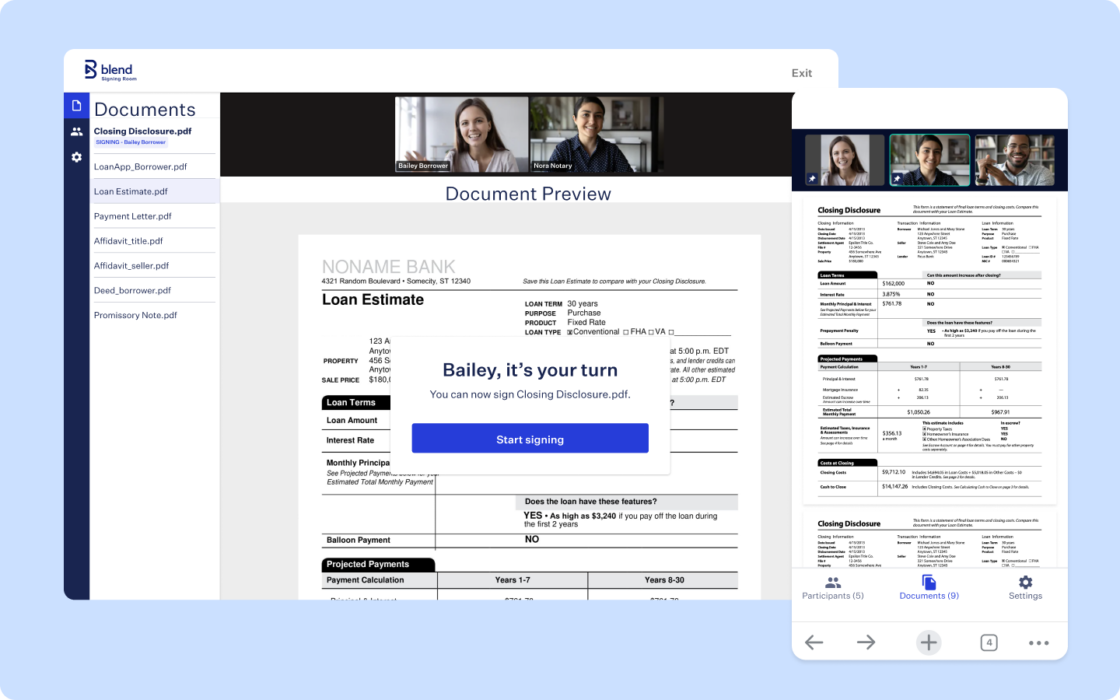

Blend can facilitate an end-to-end experience, from application intake through closing and disbursement. What does this mean for customers? A fast and smooth experience. As an added bonus, with Blend, customers can e-sign, completing the process remotely.

Provide the personalization customers demand

Blend offers seamless borrower single sign-on (SSO) from any digital device so lenders can authenticate and pre-fill previously provided customer information. Co-pilot enables loan teams to provide real-time assistance to borrowers throughout the application process, even in situations requiring social distancing.

Deliver loans to consumers faster

Pre-approving customers in a single session helps signal that the entire loan experience is modern, digital, and consumer friendly. Once a loan is approved, Blend passes along closing details to the LOS, giving lenders the ability to disburse funds quickly.

Improve efficiency with automated stipulation requests

Analyzing borrower data and documents in real time can save time and effort. Blend’s platform automatically detects and surfaces important issues at the time of application, reducing the number of processing and underwriting touches required.

Achieve even more with Blend’s cloud banking platform

Our commitment to financial institutions doesn’t stop at transforming the personal loans experience. Our cloud banking platform provides a streamlined, intuitive interface across all consumer banking products — including credit cards, auto loans, home equity loans, and deposit accounts.

“Customer expectations are changing and lending is becoming more of a transactional model. Our customers expect to interact with us in digital ways, just like they do in any of the other consumer experiences — like ordering a pizza. So we chose Blend to focus on meeting changing consumer expectations,” said Daniel Brittain, vice president of enterprise applications at Rural 1st.

By using a unified platform, lenders can rapidly deliver the best-in-class experiences that today’s consumers expect, and across your product portfolio. Our consumer experiences combine guided application flows, responsive design, and data pre-fill to drive higher digital conversions.

What’s more, we’ve built configuration into every layer of our platform, covering product experiences, orchestration, data services, and integrations. This means lenders can quickly deliver banking products that are personalized for your customers. With our modular platform architecture, lenders can integrate external services once and use them across all of your business lines.

Ultimately, Blend allows lenders to be there for customers at their moments of truth — the pivotal times in their life when they really need the most help. By providing an effortless experience at these times, lenders can create trusted relationships that stand the test of time — and that’s the gold standard for today.

Our platform powers better lending across product portfolios

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.