January 30, 2024 in Consumer Banking Suite

Introducing Shopping Cart for Deposit Accounts

Establish multi-product relationships in the time it takes to open a single deposit account.

Bankers and consumers today are still faced with the headache of needing to complete separate applications for each deposit account they intend to open. Opening two accounts takes two times longer, requires duplicative data entry, and is two times as expensive than opening one account. Bankers end up spending too much time on data entry and manual verifications, and not enough time on relationship onboarding. Consumers end up frustrated due to the duration and complexity of opening multiple accounts.

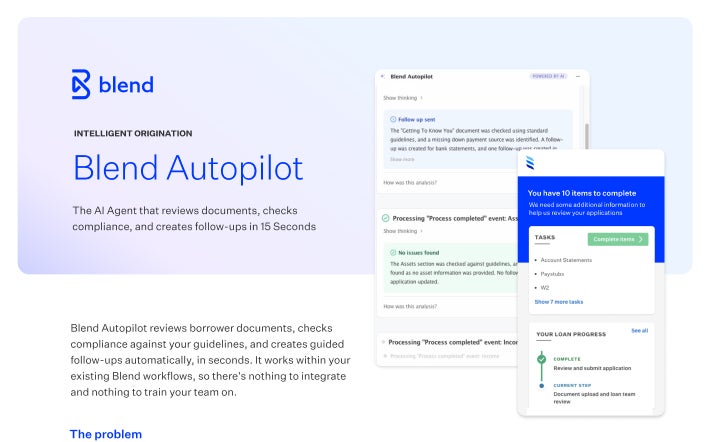

That’s why we’ve built the Shopping Cart—a new feature where bankers and customers can add their selected deposit products to a cart, enabling them to originate multiple relationships in the time it takes to open a single account.

How it works

Add available deposit account products to a shopping cart. Pre-fill a single application from first or third party data sources. Complete eligibility and identity verification. Surface product specific terms and disclosures, and create multiple ready-to-fund accounts in just a few minutes.

Save everyone time and effort. Minimize time doing manual data entry and spend more time doing discovery with customers, understanding their financial needs, and helping them select the products that make sense for their financial goals, all in one application.

Consumer benefits

- Add and configure different accounts at the same time, saving time and effort

- Manage and track accounts through a single online banking platform

- Maximize potential cross-account benefits

- Design a personalized financial strategy and allocate specific funds to each account category

Banker benefits

- Deepen relationships with speed and ease: Establish multi-product relationships in the time it takes to open a single product relationship

- Reduce abandoned account applications: Convert consumer interest into activated accounts by removing both real and perceived headaches when migrating multi-product banking relationships

- Manage the cost of origination: Leverage results from individual verification services across multiple product requests. Increase banker capacity to onboard productive banking relationships. Boost the return on your marketing spend

- Elevate in-person experiences: Minimize data entry and manual verifications and focus instead on relationship onboarding. Maximize the value of new banking relationships by guiding people towards financially beneficial action

Bottom line

Shopping cart enables financial institutions to acquire new members, expand relationships, and win more share of wallet.

Interested in putting the consumer first?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.