April 24, 2024 in Consumer Banking Suite

10 digital features to supercharge your deposits growth

Breaking down the most impactful features of a fully digital, end-to-end deposit account solution

The current account opening experience is still outdated

For many banks and credit unions, achieving a fully digital, end-to-end account opening solution is still a distant goal. Cross-selling experiences, omni-channel capabilities, and banker productivity tools are often lacking, resulting in suboptimal digital experiences requiring extensive customization and manual intervention throughout the origination process.

And all of these pain points have real business implications.

- High abandonment and loss of revenue resulting from interruptions and disruptions in the digital experience

- Frustrated customers when you’re too difficult to do business with, especially when migrating across channels

- Missed cross-sell opportunities due to being overly focused on application process versus focusing on the customer’s goals and financial wellness

- Slower and more expensive origination process due to highly manual and labor intensive processes

Best-in-class digital onboarding journeys

For over 12 years, Blend has been tackling these pain points. We began with the mortgage loan origination process – the most complex type of loan – and helped hundreds of customers completely redefine the origination experience for homebuyers, loan origination officers and Realtors.

We’ve since created similar transformations across consumer lending solutions like deposit accounts, credit cards and consumer loans with many financial institutions, including 7 of the top 30 financial institutions by number of retail customers.

These partnerships have allowed us to gather millions of data points that, over time, have allowed us to design and refine best-in-class digital onboarding journeys with features that are more effective at driving conversion and growth.

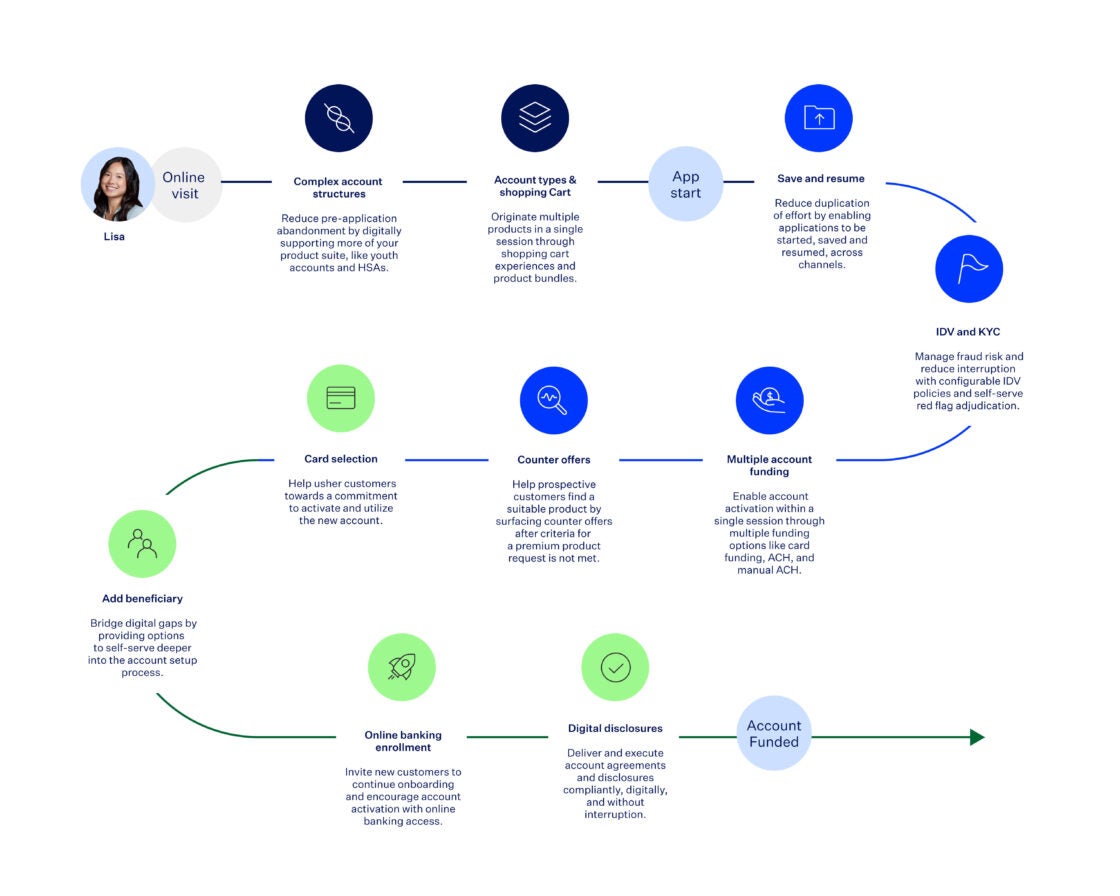

Here is a look at what a best-in-class deposit account solution with a deeper digital onboarding experience can unlock for your business.

The top 10 features powering deposits growth

Learn more about Blend Deposit Accounts

It doesn’t stop there. In addition to the rich features that enhance conversion and reduce the risk of fraud, Blend’s Deposit Account solution also offers omni-channel capabilities that meet your borrowers where they are, dynamic cross-sell offers that

deepen relationships, and much more.

Learn more about how Blend’s Deposit Account solution can help you win primary financial institution status, faster.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.