July 11, 2022 in Blend momentum

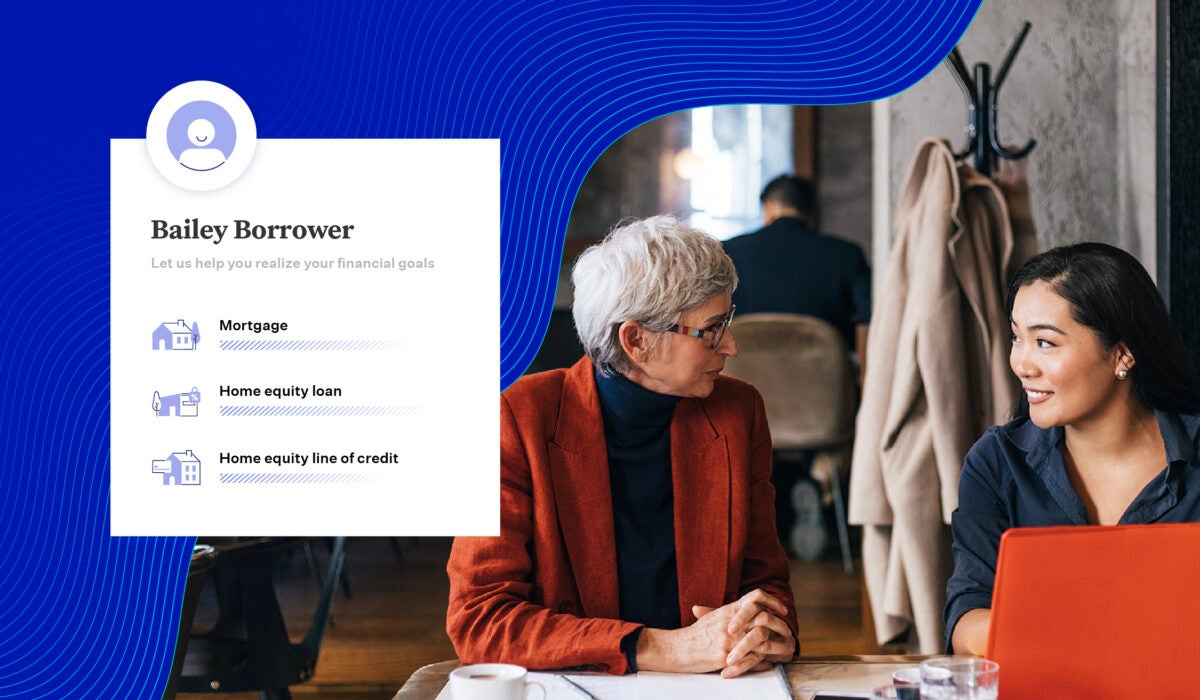

A faster future for home equity solutions

We’re building the next generation of home equity solutions – and we want you to join us for the journey.

In an industry that is dominated by constant ebbs and flows, it can be difficult to know just where to concentrate your resources. Flexibility and the ability to pivot and meet fluctuating consumer demands are critical.

Amidst current market conditions, the surge in home purchases and refinances has been dying down. But as consumers’ priorities have shifted along with the market, many people are increasingly turning to other solutions, like home equity, to improve or maintain their financial well-being.

Home equity is currently a huge opportunity for financial institutions. Our own data shows a 100% YOY increase in consumer demand for home equity. The data also shows an increase in the amount of equity homeowners are looking to access. It’s not just that more people are seeking to tap into their home equity, but that people are applying for more when they do. According to the Federal Reserve, their tappable amount just reached an all-time-record $27.8 trillion, giving more Americans the opportunity to add another level of financial security for the future.

Blend’s customers and partners are our top priority. As such, we’re proactively responding to that market demand and are continuing to improve our home equity solution to better accommodate our customers — so that they can better serve theirs.

Tapping into home equity demand

Consumers are feeling the impact of inflation, higher interest rates, and increased home value, which is driving the surge in demand for home equity lending. With a potential recession on the horizon and looming limited economic mobility, many homeowners are experiencing more financial struggles and are increasingly feeling the negative impact of constraints on their personal finances.

Back in stock: new home equity insights.

Subscribe for industry trends, product updates, and much more.

Tapping into home equity can be used for many different purposes. From putting it back into your home through renovations or upgrades to consolidating debt, planning for retirement, or even peace of mind by creating an emergency fund for unexpected moments, home equity can give consumers more financial flexibility.

Consumers are currently reassessing their financial well-being and looking for alternative solutions to ensure financial stability. With record levels of consumer home equity, lenders are poised to strengthen their customer relationships by offering valuable guidance for the home equity lending process.

But providing those services alone no longer meets consumer expectations. With everything from home grocery to car delivery, and one-stop online shopping experiences, changing trends in consumer behavior and expectations have made streamlined and intuitive digital experiences table stakes. And when it comes to digital convenience, home equity is no exception.

Tying it all together

The unprecedented wave of refinancing and mortgage originations changed the digital landscape in the financial services industry. And many lenders understandably prioritized deploying and marketing digital solutions to meet those consumer needs.

However, with the recent market shifts and increased consumer demands for home equity, financial institutions stand to benefit from bolstering their digital home equity offerings. Imagine a home equity loan that could be completed, start to finish, as quickly as a credit card application. The same technology that is used to reduce cycle time for credit card applications works just as well for home equity products, and benefits lenders and consumers alike.

We’re building configurable features for our single system, cloud-based platform, like instant income verification, automated appraisal, instant title, and flood check and home insurance policy verification. Lenders will be empowered to efficiently, seamlessly, and consistently meet consumer needs in any type of market.

A faster future for home equity

At Blend, we understand the power and potential of investing in innovative technology that will redefine and reimagine traditional offerings. Data-driven and strategic approaches are key to delivering financial solutions when, where, and how consumers want.

The surge in demand for streamlined home equity solutions presents another opportunity to show consumers that financial services institutions are committed to improving their financial well-being at every turn. It won’t be the last surge or change the market sees.

Technology evolves, markets shift, and consumer demands change accordingly. We believe in continual improvement and our ability to leverage innovation to meet our customers’ needs. We want you to join us as we continue building and refining a next generation home equity solution so that we can be there for you now, and in the future.

Want to take advantage of next generation home equity solutions?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.