September 29, 2020 in Blend momentum

Blend’s Consumer Banking Suite: Solutions for every life milestone

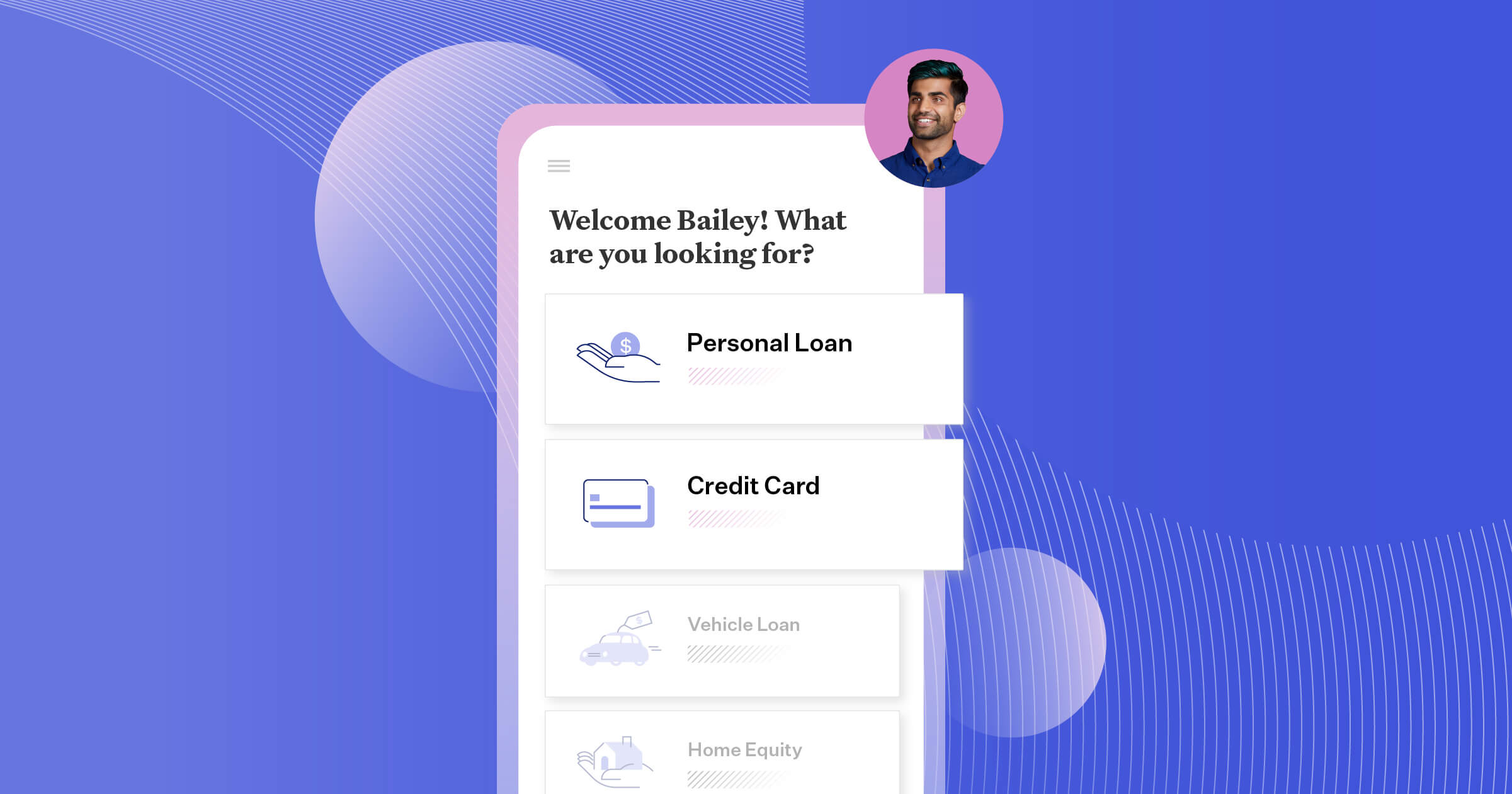

As you hopefully saw, we recently announced our expanded Consumer Banking Suite and new configuration capabilities. I want to take a moment to highlight how our expanded suite now covers every major product line, allowing your business to benefit from a unified platform supporting credit cards, personal loans, and all vehicle loans, including specialty vehicles.

The last few months have accelerated an existing shift in how consumers access financial services. The global pandemic has forced service providers to come face to face with consumer expectations that include on-demand, digital access. These expectations aren’t new — they formed over the past decade from consumer products that push the envelope in every sector from communication, transportation, entertainment, and dining. But lenders face challenges in meeting these expectations in financial services, especially as they aim to provide instantaneous and intuitive experiences across their portfolio. Consumers have high expectations and more choices than ever; if you can’t be there for all their life needs, you can’t expect them to stay with you.

We’re here to help you make a lifelong lending relationship with your borrowers a reality. The additions to our platform increase your ability to align your service offering with your customers’ important life events, so you can be there for the moments that matter most.

Broadening the Consumer Banking Suite — meet two new products

Personal loans and credit cards are the two fastest-growing debt categories in the US, according to Experian. Both of these offerings provide fast, low-friction ways for consumers to gain fast access to credit, and consumers are spoiled for choice when it comes to providers. Fintech lenders with digital-first strategies are rising in prominence, and the pressure is on to stay ahead.

That’s where we come in. Not only are Blend’s products designed to provide the quick conversion that consumers expect, we’ve also built in the product-specific feature sets these lines of business require. Highlight rates, benefits, and terms for all of your Credit Card options, from rewards cards to balance transfer cards, making product selection clear and efficient for customers. Deliver loans, lines of credit, and overdraft protection products, with secured and unsecured variants, with our Personal Loans product.

Deepening Vehicle Loans — now serving specialty vehicles

Helping lenders be there for their customers’ financial milestones requires more than just broadening the scope of product offerings. We’re continually investing in our existing categories to ensure we are supporting what consumers and lenders need.

The launch of Auto Loans in October 2019 drove significant impact: our customers have reported that application completions tripled after implementation. To continue this momentum, we’re strengthening our vehicle loan offerings by adding support for specialty vehicles, including RVs, boats, motorcycles, and other powersport vehicles. With these new offerings comes a new name: Auto Loans are now just one of the many products served in the Vehicle Loans category.

By tapping into features including license plate lookup verification and valuation for any vehicle, lenders can offer consumers the speed and efficiency they’ve grown used to with Auto Loans for whichever vehicle they prefer to operate.

A consistently “Blend” experience at every financial milestone

Because these new offerings are built on Blend’s unified platform, they deliver the same speed and ease of use your customers have come to expect.

Starting now, you can quickly deliver a best-in-class customer experience across your portfolio. The capabilities that make our other products so high performing — including data pre-fill, single-sign on, streamlined verifications, real-time decisioning, and an intuitive consumer experience — are all available to you “out of the box.”

Now you can confidently meet customers at every milestone with a consistent experience whether they’re buying a motorcycle, applying for their first credit card, or anything in between.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.