December 8, 2021 in Blend momentum

Blend Close: Helping mortgage lenders increase efficiency and deliver a superior customer experience

Explore the progress we've made — and where we're headed — in support of an efficient, customer-pleasing, and cost-effective end to the mortgage journey.

As humans, we can’t help but to celebrate and feel positive in the moments when we finish a task productively. And yet, for many consumers (and yes, even many lenders), the completion of the mortgage journey can still feel somewhat underwhelming.

Both parties want to feel like their time was well-spent and even rewarding, but the closing process can be complicated and stressful.

We’re helping to solve this problem with Blend Close, a crucial part of our foundational technology — called the Mortgage Suite — that helps loan teams manage volume while saving time and costs involved in originating a loan. And since we launched Blend Close in 2020, lenders and closing teams are achieving faster closing times and more efficiency.

More than 125 lenders have signed on with Blend Close, including U.S. Bank, Alcova Mortgage, UCCU, AMC Mortgage, PRMG, and SWBC Mortgage. In addition, more than 21,000 settlement agents are using Blend Close to enable secure document exchange and coordination with the lending partners they work with.

To help you further achieve adoption of more digitized closings and to expedite the approval process, Blend Close is also a Fannie Mae– and Freddie Mac-reviewed eClosing solution provider.

I’m eager to walk you through the value your peers are already capturing with Blend Close; stick around for a quick walkthrough of a newly released feature we’ve developed to help you generate even greater impact.

“Our continued goal is to make the mortgage process simpler, faster, and more transparent while also providing choice for customers – the choice to choose how they prefer to apply for and close their home loan.”

Tom Wind

EVP, Consumer Lending at U.S. Bank

The impact of Blend Close

As more lenders and settlement agents began using Blend Close, we wanted to better understand how much time and money our customers were saving. We conducted an in-depth customer survey and couldn’t be more pleased with the positive results.

For hybrid closings, for example, financial services firms saved $135 per loan due to reduced labor, shorter loan cycles, fewer errors, and use of e-signatures versus printing and shipping documents.

Lenders also reaped the benefits of saving time in the closing process in general. Here are some impressive averages:

- Lenders were able to take two days off their closing times

- Closing teams completed two more loans per day

- For a hybrid close, lenders saved 61 minutes per loan from streamlined borrower communication and reviewing fewer documents

These were just a few of the sizable survey results. If you’re curious about how lenders are finding value from Blend Close, here is a deeper dive into the findings.

To continue this step in the right direction in our quest to improve ROI and deliver feel-good closing experiences to borrowers, here’s a quick overview of a new feature we developed for Blend Close.

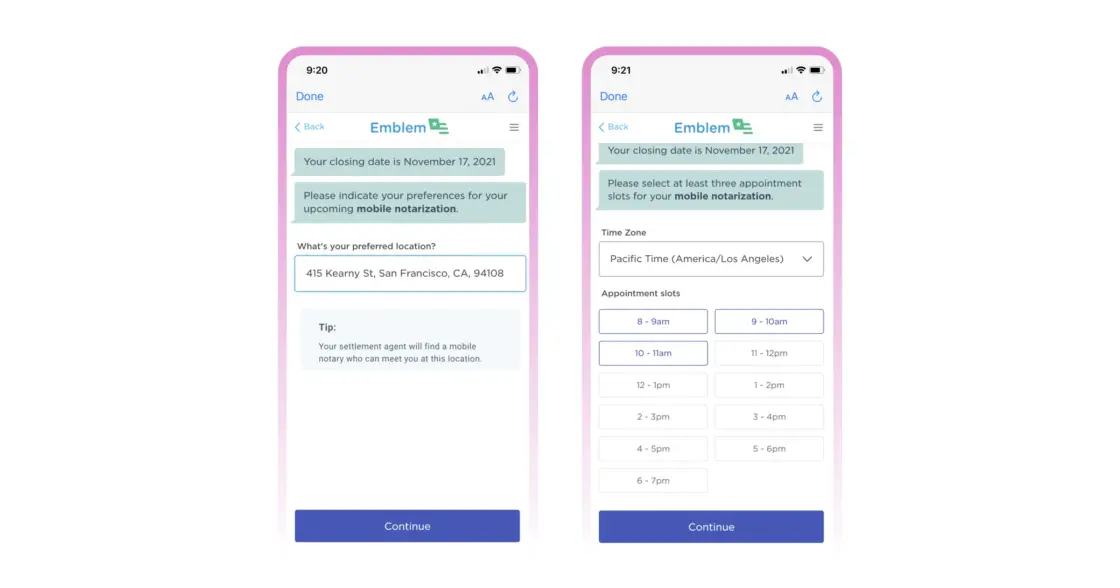

Integrated scheduling that puts control back in borrowers’ hands

During the closing process, scheduling can be time-consuming and require back and forth between settlement agents, loans teams, and consumers. Booking an appointment over email can get messy and produce longer-than-necessary threads. Phone calls may also turn into an unwanted game of phone tag.

Now, when borrowers are logged into Blend, they have the ability to easily choose a time to close, whether they are closing online via remote online notarization or meeting a notary in person.

Borrowers are prompted to share their closing preferences and then to select available time slots. By keeping all parties informed and updated, it’s just one more way Blend is helping facilitate a faster close and ultimately, a better closing experience.

“Our digital application adoption was nearly 100 percent pre-pandemic and integrating Blend Close to the process now gives customers the option to review and sign documents at the time and place of their choosing. The rapid adoption we have experienced has streamlined our process, driving both an increased employee and customer experience.”

Tom Wind

EVP, Consumer Lending at U.S. Bank

Continuing the momentum into 2022

As 2022 quickly approaches and you seek ways to combat margin compression and stay competitive, getting on board with digital closings may be crucial to your strategy.

We won’t be resting on our laurels. In addition to the feature I outlined above, we have a deep roadmap of additions and improvements scheduled for the foreseeable future. Our commitment to your success challenges us to continuously deliver increased value for you, your teams, and your customers.

And for your customers, closing marks the last big to do, a milestone moment before finally getting the keys to their new home. Let’s partner to create a positive experience that culminates on a high note by increasing convenience and control for your borrowers. With Blend Close, we can bring a celebratory energy back to homeownership.

Learn more about how we’re simplifying the digital process for closing teams and elevating the borrower experience

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.