May 31, 2023 in Mortgage Suite

Best practices for optimal outcomes: A Blend Close implementation guide

Change can be hard, but it doesn’t have to be — especially with a solid implementation plan.

Customer success is often the result of creating a tried and true implementation plan. We’ve guided hundreds of customers through Blend Close implementations. And we know that every successful deployment is the result of a solid plan of attack, which gives you the stability you need when fate jumps in and forces the team to deviate from the best case scenario.

Much like your own customers’ closing days, we want your Blend Close rollout day to go as smoothly as possible, so check out our best practices for optimal outcomes below.

The more things change

Ready to jump into deployment? Quick pause.

Before doing anything, you should take some time to reflect on why you’re making the change to Blend Close, and then discuss it with your team. There are a few anchors that are important for everyone to understand:

- Metrics: How has your current close solution been performing? How long does it take to close a loan?

- Return on investment (ROI): Are you getting the most bang for your buck? What kind of ROI can a different solution offer?

- Efficiency: How much time does your team currently spend on manual tasks? Can a more efficient process lead to fewer errors?

- Ease of use: Does your team find your current process user-friendly? Do your borrowers? What kind of changes could make the process better for everyone?

Change is hard. And having more insight into what is driving the switch can help people as they potentially struggle to adapt to a different system. Plus, your team can get the most out of the Blend Close experience after seeing firsthand how the newer capabilities can help them.

Benefits across the board

After making sure your larger team is aware of the impending changes, take the time to really think about how each individual function will be affected, and keep preparing them to make sure they can see the value in such a “disruption.”

In 2022 Blend conducted an ROI survey with MarketWise Advisors, which revealed significant cost and time savings benefits — make your whole team aware of what a new close solution can do for them:

- For loan officers: close two days faster on average

- For closing teams: fewer possible errors (including error corrections), the ability to close two more loans each day, and a total time savings of 61 minutes for each loan closing

- For everyone: 11% fewer doc errors, 13% reduction in signature errors, and a 12% reduction in missing notes

Leadership should be closely involved in this process; teams need to see them talking about it early and often, and leaders should have a visible presence from start to finish.

Be prepared

Settlements agents, loan officers, and borrowers should all be adequately prepared to ensure success all around. Setting expectations is important — here are some best practices:

Settlement agents

- Let your settlement agent partners know ahead of time that you’re launching Blend Close

- Share your reasons for choosing Blend Close with them and ensure that they know you want them to follow the process/use Blend Close

- Show where they can find help

- Reach out to your Blend account partner for live training options

- Use Blend’s Help Center to access our Settlement Agent Workspace resources, where you can find instructional videos and other self-help instructional materials

Loan officers

- Conduct LO-specific training and make sure to leave plenty of time to address concerns

- Make sure you clearly communicate that the new process and workflow will make it possible to process more loans — and more loans lead to more commission.

- Anticipate resistance and plan accordingly

- Create incentives for early adopters

Borrowers

- Create instructional materials and other relevant self-serve resources to help borrowers get the most out of the Blend Close borrower portal

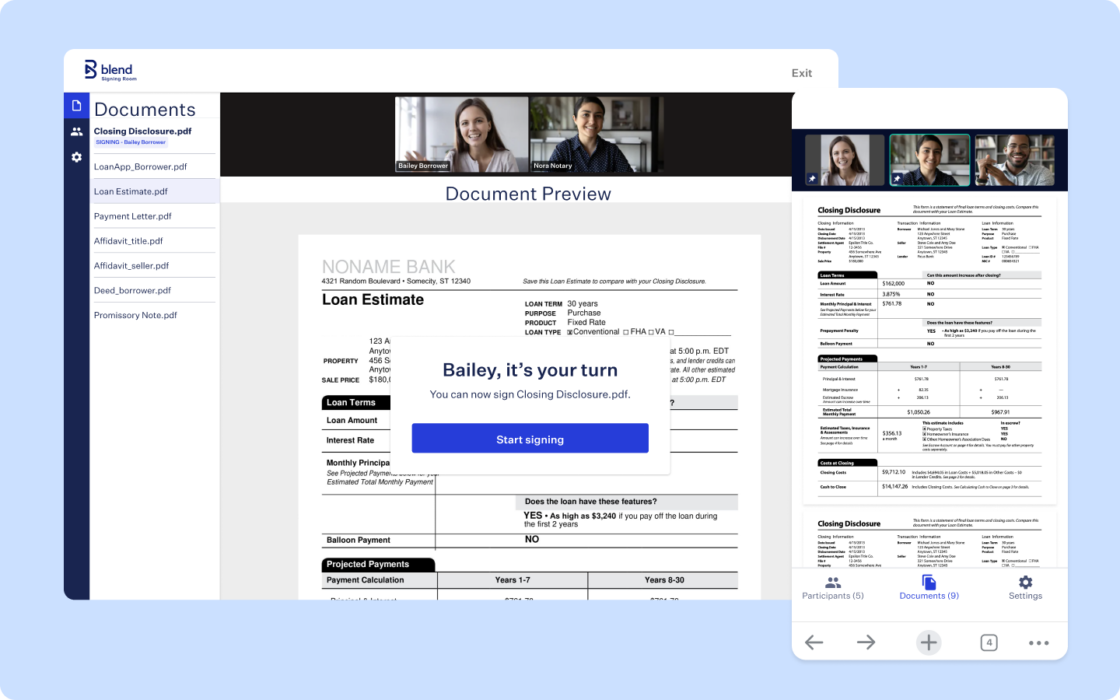

- Create short videos or other materials that explain what the process will look like and how hybrid and/or RON closings benefit borrowers

Metrics, metrics, metrics

As with any new tool or process, measuring its impact is critical. You’ll want to know how often Blend Close is utilized, which can be measured by things like LO usage, increase in number of closings per LO, a decrease in errors, etc. If your goals aren’t being met, you’ll be able to figure out why and course correct earlier.

It’s also important to realize how the new change is impacting your team. You can do this by seeing how many people are using the new process, conducting a survey about how the implementation went, and tracking attendance to training sessions and/or launch events.

Hit the ground running … and keep the momentum going

As we’ve said, change can be hard. Which is why it’s important to make launch day fun for your whole team. As such, make it an event; give out prizes and try to promote the change in a positive way.

After the big day has come and gone, and out of habit, your team might gravitate towards what’s familiar. Remove the temptation to do so and continue emphasizing the importance of change and its impact on business through positive reinforcement.

Curious to see what other FIs are saying about Blend Close?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.