December 20, 2022 in Mortgage Suite

Webinar: Power up your mortgage experience with tailored engagement

Deepen engagement and increase pull-through with the Blend Mortgage Suite.

Keeping borrowers engaged and responsive throughout the mortgage process is crucial to help speed up turn times, get more loans to closing day, and build valuable, lasting relationships. But how can lenders ensure they’re doing all they can to keep their customers’ attention?

Personalization is becoming a necessary asset across industries and is a major priority for many financial institutions. According to a Forrester Consulting study commissioned by Blend, lending institutions with more mature personalization were nearly three times more likely to outperform their goals in cross-sell and customer acquisition.

Blend customers will find that implementing personalization and tailoring the mortgage process is now a reality in the Mortgage Suite. In fact, our product solutions and features help improve the financing experience for both borrowers and loan teams.

In this Mortgage Power Up session, we’re demonstrating how lenders can customize the Mortgage Suite with three recently announced features. Watch the webinar here on-demand and read the highlights below to learn more about how these features help drive better engagement and increase pull-through.

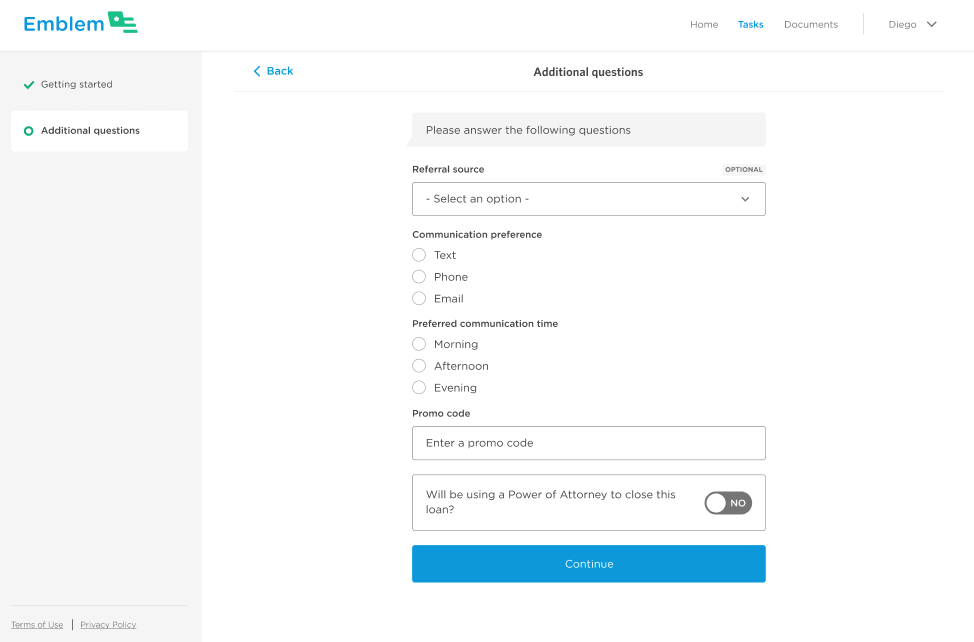

Custom Questions to help better understand borrower needs

With Custom Questions, lenders can save time (and money) wasted on follow-up after follow-up gathering information left out of the application. By tailoring the questions in the application process, you can bypass much of the time-intensive follow-up process and keep customers moving through toward closing.

For example, lenders can ask up front and on the application if customers have a preferred name, any promo codes, a referral source, or if they’d like to be contacted via email or text.

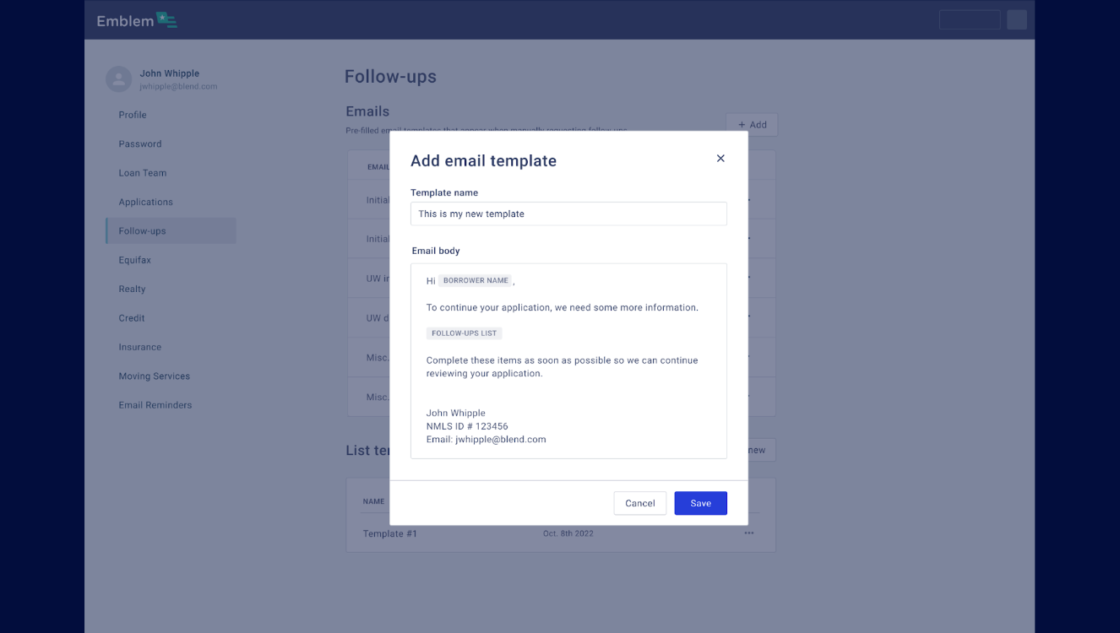

Customizable Email Templates to help keep borrowers engaged

Meaningful conversations with borrowers build trust, confidence, and, ultimately, a relationship that lasts beyond closing day. Using email templates written in a voice that borrowers are familiar with enforces authenticity and warmth.

Customizable Email Templates give lenders more control over their borrower conversations. With the ability to customize send times and frequency of manual and automated follow-ups, lenders can add their own personal touch to their communications and make sure their customers are feeling heard. Lenders can create a limitless number of templates for virtually any scenario, including to follow up, congratulate a borrower on closing, or just to check in.

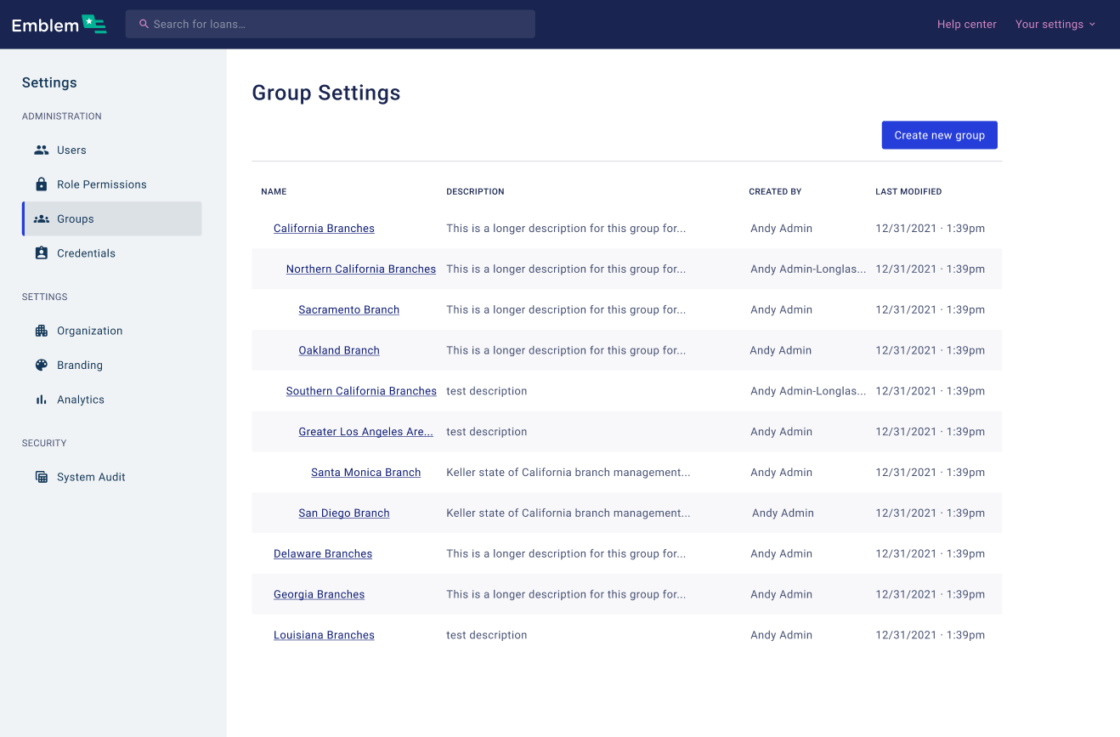

Branch Management to help give more control to loan teams

Branch Management helps make a more organized and streamlined workflow by enabling individual branches to focus on loans that are only applicable to them and branch managers to easily access and manage their branches.

This feature makes it easy to bring the rules of your organization into Blend and allows lenders to create a hierarchy of branches (just like how it’s structured in the “real world”). It doesn’t matter how big the organization is — admins can create as many branches in Blend as they need.

Deliver valuable mortgage experiences

As financial institutions are seeing a limited borrower pool, responsive, authentic, and personalized borrower engagement and communication are especially necessary. Blend users will find it easy to cater to this need by customizing the mortgage process for loan teams and personalizing the experience for borrowers with the features highlighted in this webinar and many of our other offerings.

While Mortgage Power Up: Leveraging Tailored Engagement showcases three of our most recent innovations, we offer a wide range of Mortgage Suite features and capabilities that tailor the financing experience, streamline steps of the loan process, help save time and costs, and keep customers engaged from application to closing day.

Are you using the Mortgage Suite to its full potential?

Power up the mortgage experience.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.