June 28, 2022 in Thought leadership

The importance of putting home equity to work in 2022

There’s no better time than now to help consumers find a great home equity solution that works for them.

Why home equity matters to your bottom line — right now

2022 is shaping up to be a year of major market shifts. With fewer people predicted to enter the housing market, experts are forecasting a marked decrease in both purchase and refinance mortgage volume. But the same factors that are giving consumers pause also present an opportunity for lenders who offer products that do speak to their financial needs.

The combination of higher interest rates and more equity-rich homeowners could lead to a surge in home equity market share demand. Establishing an intuitive and streamlined home equity process now is so much more than maintaining a competitive edge. It’s showing consumers your unwavering commitment to their financial well-being in any type of market.

A perfect storm of market conditions

Inflation, increased housing prices, and higher interest rates are just some of the challenges a choppy market has created for consumers. And both current and potential homeowners are feeling daunted by the looming limited economic mobility, to say the least.

Inflation has been a major issue for Americans this year, and has limited their buying power even further, both in terms of homebuying and in meeting other financial goals.

BMO Harris’s latest Real Financial Progress index, completed quarterly, found that 80% of Americans surveyed plan to change their actions to offset the impact of inflation and rising costs of everyday essentials. The survey also found that nearly 60% said that inflation had adversely affected their personal finances.

Did you get the latest forecast?

Subscribe for industry trends, product updates, and much more.

In addition to accelerated consumer prices, the combination of record-high home prices and record-low inventory is making homeownership increasingly difficult for consumers. Even current homeowners looking to move are facing the reality that they may not be able to afford comparable or better properties. On top of that, rapidly rising interest rates have further compounded affordability challenges.

However, the news isn’t all bad for consumers. Many of the same factors that contributed to higher housing prices have also contributed to unprecedented increases in home value and as a result, an increase in home equity. This hidden treasure trove of equity could be a boon for existing homeowners struggling in a down market and for lenders looking for an opportunity to serve them.

Consumers are leveraging home equity for a wide range of use cases. Many, like consolidating debt or covering large essential purchases, have direct tie-ins to the current market conditions. Just as common is leveraging equity for home improvement projects or repairs, especially for those who found that they don’t quite have enough to purchase a new house but would like to upgrade their existing space. Working with a trusted lender can help these borrowers tap home equity responsibly and use it to achieve their own financial goals.

Home Equity is the big wave of 2022

Proactively understanding and responding to consumer needs – in any market environment – is critical for better customer experiences and increased satisfaction. Understanding why home equity is shaping up to be a major factor this year for many consumers is key for financial institutions who want to be trusted advisors that help consumers navigate the various challenges that uncertain market conditions can create.

Many of the current market conditions are not likely to ease up any time soon. That suggests that this will be a medium- to long-term trend and one worth noting for lenders. For many homeowners, as other pathways to financial goals begin to become more difficult, tapping into their existing home equity is a good way to meet short, medium, and even long-term financial goals.

More importantly, the rapid rise in equity over the last couple years means that home equity solutions aren’t just limited to long-time homeowners who have slowly accrued equity over several decades. You might have helped a customer with their mortgage in 2019. With the unprecedented gains in value, even relatively new homeowners can take advantage of home equity solutions to meet many common financial needs.

How Blend fits in

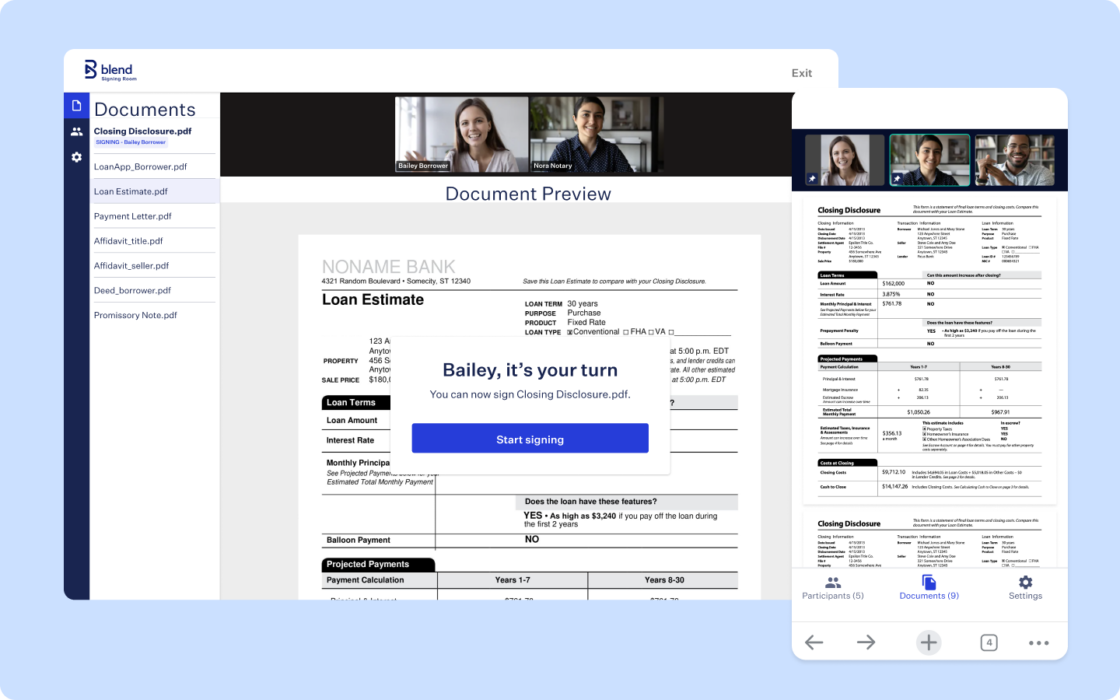

Blend believes that partnering with financial services providers is key to finding solutions that work for consumers. We built Blend Home Equity to provide the kind of end-to-end digital experience that borrowers expect.

By combining technological speed and innovation with decades of financial expertise and customer loyalty, financial institutions can tap into the agility needed to offer services that are tailored to all consumer needs, regardless of market conditions. Markets change, and so do peoples’ needs. But providing a lifetime of trusted, proactive, and customized service is a constant.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.