February 10, 2022 in Consumer Banking Suite

Examples of cross-selling in banking: Transitioning to a modern approach

A fresh approach to cross-selling can help financial institutions improve their customer experience and win more business.

Across industries, it’s well known that the cost of selling to existing customers is far cheaper than the cost of acquiring new ones. In fact, it can cost five times more to attract a new customer.

That’s why effective cross-selling — the process of offering current customers complementary products or services — is so beneficial in banking. So much so that it has remained a key focus of financial institutions’ business strategy over the past several years.

But it’s getting more difficult. Changes heightened by today’s digital age have decreased cross-selling opportunities; bankers have less face-to-face interaction with customers and increasingly disparate product lines. And as customers demand more personalization in their banking experiences, traditional cross-sell techniques are becoming less effective.

Traditional examples of cross-selling in banking

Want more complementary knowledge?

Subscribe for industry trends, product updates, and much more.

Relationship-based cross-selling in banking is a largely manual process. For example, a banker might establish by chance that their customer is looking for a new car and offer an auto loan as a result. These tactics rely on the banker’s understanding of the customer’s wants, needs, and current financial situation. Without access to systematic and detailed data about the institution’s customer base, personalization is dependent on an engaged and inquisitive sales staff. For many institutions, this approach may be difficult to scale.

Another example of the traditional cross-selling process is the blanket initiative. Take a credit union, for instance, which might send a direct mail blast to every one of its members pushing auto loans. With little personalization or understanding of member needs, this approach can result in poor conversion rates.

Supercharging the cross-sell process with digital

Digital technologies can give financial institutions the insight they need to better serve their customers and significantly boost their cross-selling effectiveness.

Technology solutions help financial institutions use existing customer information such as recent purchases, important life events, and future goals to make more personalized, beneficial, and relevant offers.

Let’s take a look at a hypothetical scenario for a first-time home buyer, Sandra:

- Sandra applies for a mortgage online and receives a message during her application suggesting that she opens a checking account at the same time, so that it is easier to make payments.

- The information garnered during the application tells the bank that Sandra is a first-time homebuyer and therefore might be looking for a line of credit to purchase high-value new items for her house, such as furniture and kitchen appliances.

- A personalized email is then sent to her, offering a special rate on a credit card based on her custom creditworthiness score.

- The email includes a link to an application ,which is pre-filled with the information Sandra has already provided when she took out the mortgage, so she can complete the remaining fields in a matter of minutes.

This level of personalization is what makes a digital cross-selling process more successful. Rather than feeling bombarded with irrelevant offers, customers are more receptive to this approach. In fact, 70% of digital customers said they would be highly interested in receiving tailored insurance offers from their banks based on their transaction data. What’s more, customers are more than twice as interested in these offers if they have recently experienced a significant life event or made a major purchase.

How Blend enables smarter, smoother cross-selling in banking

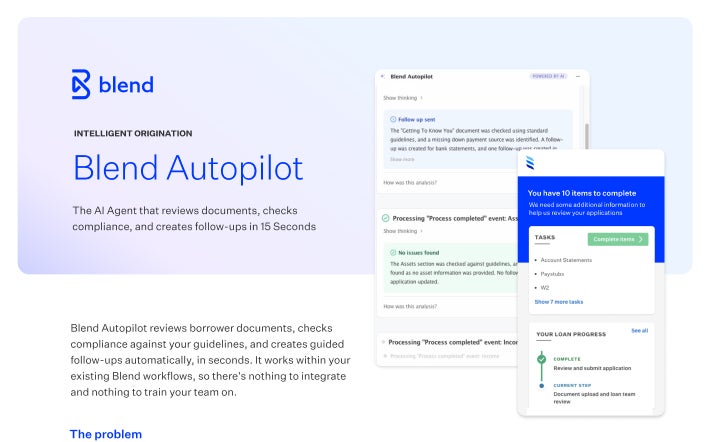

At Blend, we understand the importance of effective cross-selling to better serve your customers. That’s why our cloud-based banking platform includes a dedicated cross-sell feature that allows financial institutions to make well-timed and personalized offers.

Using Blend, financial institutions can make cross-sell offers directly within the application experience and personalize those offers based on application information, FICO score, and tradeline data.

Customers can claim their cross-sell offer in a few clicks with Blend’s “review and submit” feature. Mortgage applicants, for example, can simultaneously open a deposit account to make the payment process easier. To do this, they can simply review previously provided application information in one screen, without the need to re-enter the same information again.

Blend’s Consumer Banking Suite simplifies the lending process across all products, whether it’s deposit accounts, credit cards, personal loans, vehicle loans, or home equity.

We help financial institutions deliver the personalized and relevant offers that today’s consumers are seeking. We’re here to help lenders play a trusted role in borrowers’ financial journeys and, as a result, build stronger customer relationships and improved loyalty.

Want to learn more about how you can win more business?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.