July 23, 2019 in Challenges and solutions

7 ways to spot an outstanding lending technology services partner

As technology evolves, solving core business challenges becomes increasingly complex. Due to legacy technology and dated processes, lenders face pressure to transform all aspects of their business, increasing the need for holistic solutions. However, getting to the right tech stack decision can be a major hurdle. Enter: the lending technology services partner. Digital lending services open the door for lenders to improve their operations and elevate the experience they provide for customers.

The digital arms race, while offering an inspiring future-state for all companies, is causing a massive headache for in-house technical teams trying to keep pace with innovation. They’re challenged to find ways to augment their services without disrupting day-to-day processes or ripping and replacing core technologies. They also need to avoid managing a ballooning number of vendors with hard-to-measure ROI and inevitable interoperability challenges.

Technology partners have emerged to help lenders with digital transformation — how should lenders think about separating the signal from the noise?

Advantages of lending technology services

Lenders are constantly seeking ways to augment their services without disrupting day-to-day processes or ripping and replacing core technologies. Ideally, these improvements would emerge without the need to manage a ballooning number of vendors with hard-to-measure ROI and inevitable interoperability challenges.

Digital lending services supply powerful technology and resources that equip lenders to work more efficiently, provide a better customer experience, and retain clients long-term.

When vetting different lending technology partners, how should lenders separate the signal from the noise? In this article, we’ll cover seven key characteristics to look for in top-tier lending technology services.

Seven things to look for in lending technology services

The right lending technology partner provides streamlined solutions that put your business on the map for long-term success. We talked to our 225+ partners about the traits they value most when exploring different digital lending services. Here are seven traits to look for in a new technology partner:

The seven most common characteristics of top-tier lending technology partners

We talked to our 170+ lender partners about what makes a technology partner great to work with. These are the most common responses we heard:

1. A full suite of services under one contract

Avoid having to manage multiple contracts with different vendors. Taking the platform approach ensures a unified experience across your digital lending services. Working with one technology partner provides long-term benefits because they take your feedback into consideration, anticipate trends, continue to build out functionality, and offer new solutions.

2. Streamlined access to third-party integrations

Escape expensive and time-consuming integration work. Blend puts an extensive list of integrations at your fingertips, including Fannie Mae and Freddie Mac, DocuSign, Equifax, and Finicity. These powerful integrations deliver seamless results across a variety of categories:

- Connectivity and verification

- Document preparation

- Pricing, credit, and underwriting

- Loan origination and customer relationship management

3. Aligned success goals for less front-end risk

Build toward mutually beneficial outcomes. A trustworthy digital lending service helps you close more loans faster, with minimal chance of error. The right partner should feel like an extension of your in-house team by augmenting existing capabilities and working toward the same goals.

4. Right-sized solutions for large and small organizations

Compete effectively, no matter what size you are. When a technology partner takes the time to understand your operating model, team size, and expected outcomes, you benefit from digital lending services that align with your specific needs. Some lenders may be making the first exciting venture into digital technology, so a simpler setup is sufficient. Others may be considering a major digital expansion, requiring a more robust technology implementation. A strong technology partner has a scalable platform that supports lender needs across the complexity spectrum.

5. Solutions that match consumers’ technology expectations

Consumers now have high expectations for fast, intuitive, and personalized experience. Increase your total addressable market with a white label lending application that delivers a consistent, polished experience across loan offerings. Choose a lending technology service that allows you to assist more customers and make it easy for previous customers to return.

6. Plug-and-play capabilities with versatile platforms and broader solutions

Merely uttering the word “implementation” is enough to make most execs shiver. The best digital lending service providers understand that not every lender has the resources to support complex and time-intensive projects. Seek out providers that can minimize the internal legwork required of your IT team with easy, switch-on configurations.

7. The ability and intention to augment — not rip and replace — core services

Evolve your tech stack — don’t reinvent it. The best lending technology services work in tandem with your business. As technology evolves, your lending technology partner will be there to help you improve both solutions for your internal team and offerings for your customers.

Blend: Your premier lending technology partner

Selecting the right partner is difficult, but the decision is an essential step for leaders working toward truly future-ready organizations. The benefits of adopting a digital mortgage will only continue to grow over time, so now is the best time for digital transformation.

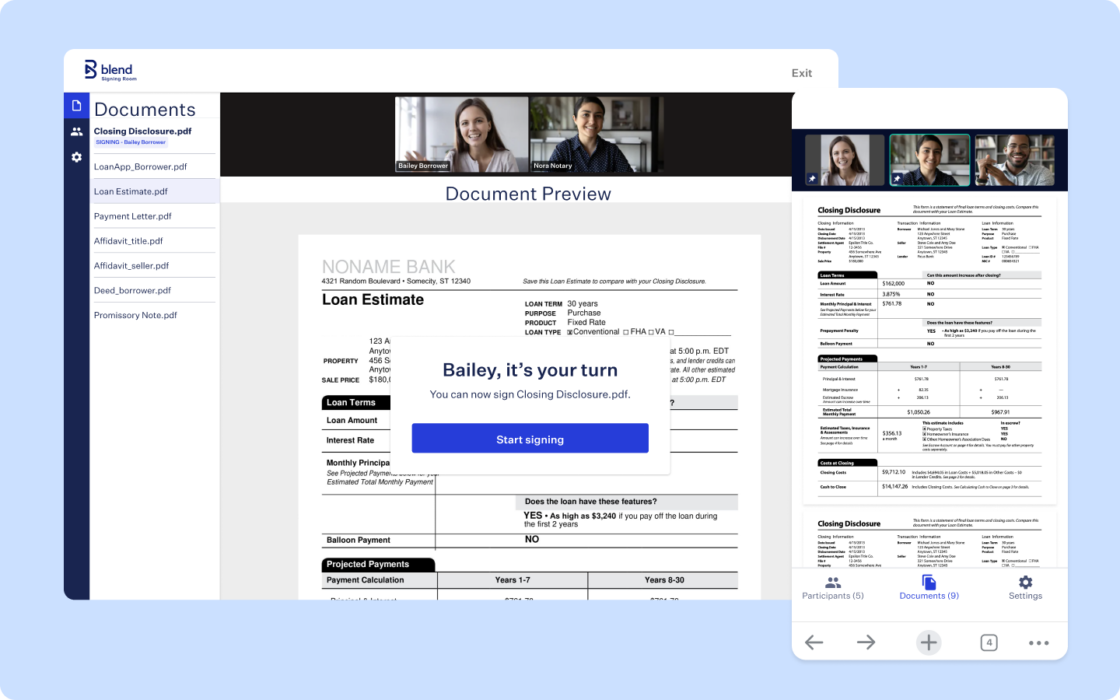

Blend’s unified platform enables omnichannel customer engagement so borrowers can start, continue, and complete loans from wherever they like. Our role-based workspaces for loan teams and bankers provide access and guidance, so team members can easily collaborate with customers and close loans faster.

By using artificial intelligence to analyze application data, Blend transforms the lending process and identifies issues that could cause delays, automates resolution tasks, and drives predictive conditioning.

Learn more about the lending technology powering more than $2B in loans per day across today’s top lenders. Explore Blend’s digital lending platform.

Looking for a deeper look into lending technology partnerships?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.