June 26, 2019 in Mortgage Suite

Introducing Self-serve Pre-approval

Increasingly, consumers are beginning the mortgage process online and demanding more ability to self-serve — especially during the earliest steps, like the pre-approval.

With a tightening market and increasing competition, leading lenders are banking on outstanding customer experiences to capture market share. Transparency and trust are key ingredients for converting applicants into satisfied customers.

We’ve built a more seamless way for consumers to start the homebuying process: Self-serve Pre-approval. The pre-approval letter enables interested homebuyers to understand — quickly and on their own time — exactly how much they can borrow, so they can confidently start shopping for homes.

By offering a streamlined and fast workflow, lenders with consumer direct channels can immediately prove their value and begin building trust with consumers who are starting their home buying journeys.

A simpler and faster workflow

We’re excited to offer a new workflow that allows lenders to make an automated pre-approval their competitive advantage. Now, consumers can easily apply online and receive a mortgage pre-approval anytime, anywhere.

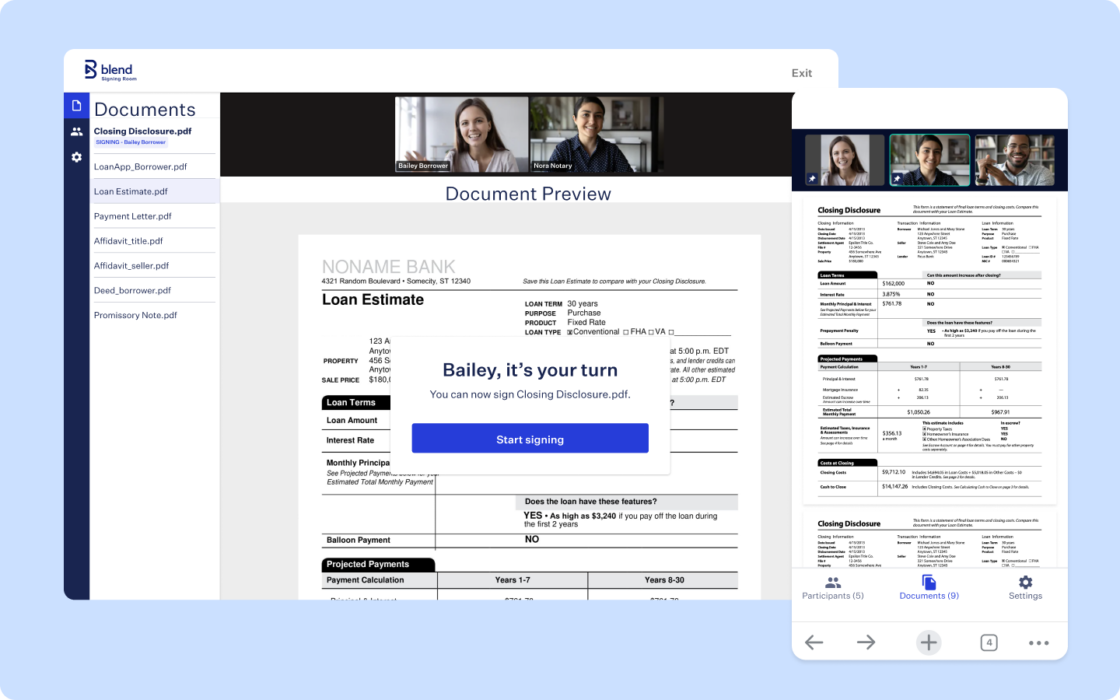

The experience in Blend is simple: after completing an application, the consumer is presented with a guided workflow to select loan options, understand associated costs, and immediately download a pre-approval letter.

Behind the scenes, Blend automatically checks credit and runs an automated underwriting system to deliver an instant result.

Consumers browsing online home listings on a Saturday night can now have a similarly comfortable digital experience starting their pre-approval — and have a pre-approval letter ready for an open house on Sunday morning.

Convert more leads to funded loans

There’s a huge incentive for lenders to build trust quickly with serious homebuyers. Pre-approvals kindle consumer loyalty. They are an incredibly ‘sticky’ — and therefore valuable — offering for lenders.

With a pre-approval letter in hand, consumers are confident both in their ability to begin shopping for a home and in their lender’s ability to successfully get their loan to close. With this confidence, applicants are less likely to shop around and explore their options with other lenders.

As an added bonus, with self-serve functionality at their fingertips, applicants can push the application process forward, even when loan teams are out of the office. Removing resource roadblocks can also increase the likelihood that a loan will convert.

Increase loan team productivity

The improved pre-approval experience isn’t just great for the consumer. When we say self-serve, we mean self-serve. Loan officers don’t need to be available for on-demand support. Consumers can work at their own pace and still end up with a pre-approval letter to shop with.

Meanwhile, loan teams can spend their time advising consumers who may have more complex financial situations that require expertise — in other words, getting challenging loans to close more quickly. Ultimately, loan teams will be able to handle more loans per person, without adding additional costs.

“By offering the ability for our members to obtain a pre-approval online, we are able to provide an answer immediately and give our members peace of mind that they are well qualified to buy the home of their dreams, all while increasing the efficiency of our team.”

Mike Long

Chief Credit Officer, University of Wisconsin Credit Union

Our commitment to delivering more value to consumers and lenders every day

The self-serve pre-approval workflow is just one stop along our journey to make the process of getting a loan simpler, faster, and safer.

We will continue to invest our time and energy in building new capabilities that deliver an unparalleled consumer experience, and in turn, increase productivity and reduce costs for lenders.

Want to see more? Get in touch with our team to see a demo of Blend’s Digital Lending Platform.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.