The emergence of digital closings has ushered in a new era of opportunity for lenders. Beyond enhancing convenience for borrowers, digitizing the closing experience has substantial benefits for lenders, including shortening the time it takes to close, reducing errors, and increasing ROI.

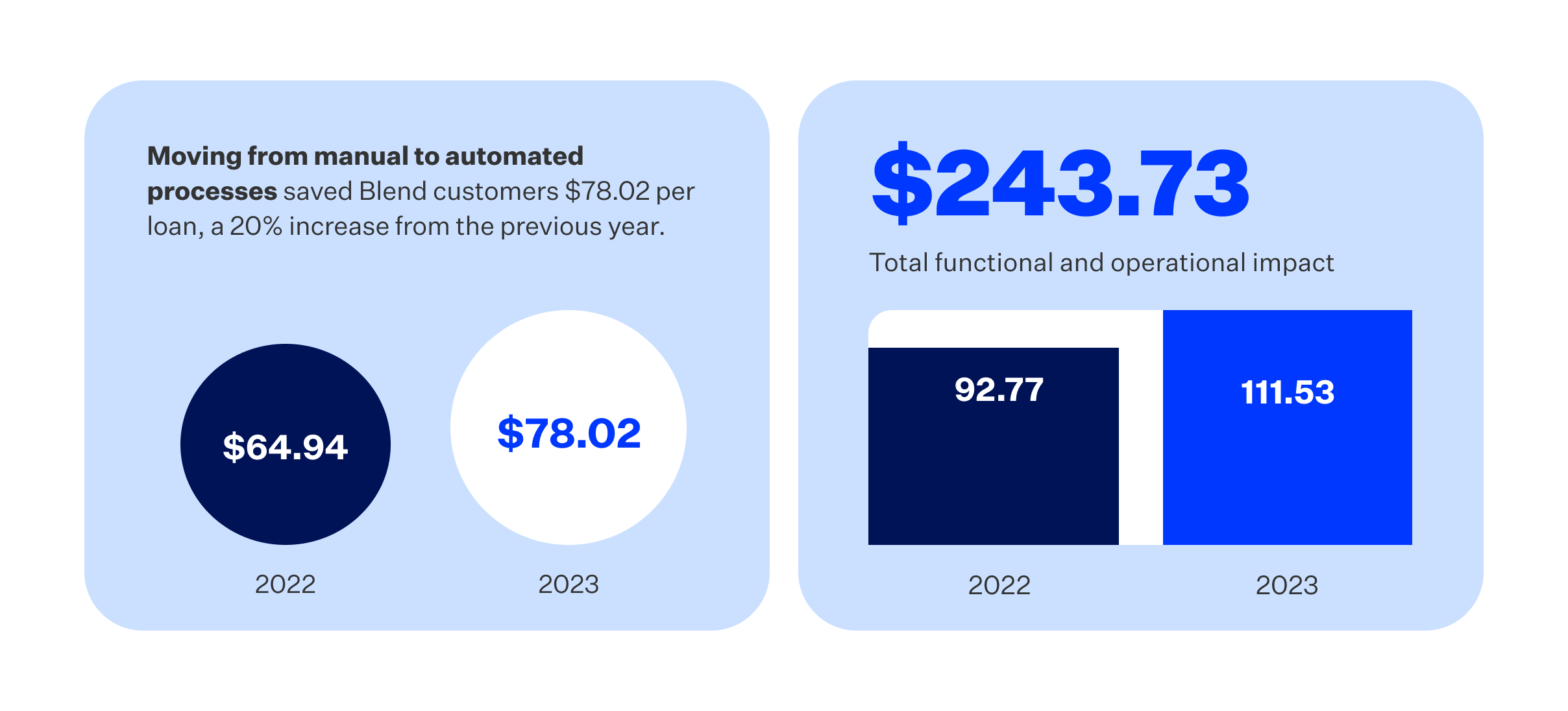

Recent data from a 2023 survey of Blend customers shows the tangible financial impact of embracing digital closings. According to the survey, lenders leveraging full eClose technology through Blend experienced a total financial impact of $243.75 per loan. This is a result of automation and efficiencies created for settlement agents, closing teams, notaries, and borrowers.

Why should lenders consider digital closings?

- Create a digital end-to-end experience: Lenders can shorten closing appointment times by allowing borrowers to eSign non-notarized documents before an in-person closing ceremony. Remote Online Notarization closing gives borrowers the flexibility to close anytime and meet a Notary, have their ID verified, and complete the closing ceremony via webcam.

- Give borrowers a digital-first approach to closing: Instead of signing everything at the closing table, borrowers can eSign some or all closing documents from the comfort of their home. This not only saves time, but leaves less room for errors..

- Save time with automation: Settlement agents will benefit from shorter closings because they have fewer documents to wet sign with the borrower. In addition, the lender has fewer documents to check post-closing.

- Faster secondary market sales: Digital documents accelerate loan delivery and post-funding processes, which means lenders recognize gains on sale more quickly while reducing hedging expenses. With fewer documents to mail, that also helps lenders save on paper and postage.

The evidence is clear: mortgage companies that embrace digitalization and incorporate digital closing solutions into their operations stand to reap significant rewards, from improved operational efficiency to heightened customer satisfaction. In an industry where every minute and every dollar counts, the ROI of digital closings isn’t just a promise—it’s a crucial step towards future-proofing your business and staying ahead of the curve in an ever-evolving industry.