Reflecting back on the hundreds (if not thousands) of conversations I’ve had with our lender partners over the past eight years, one thing is clear: there is no shortage of ideas for how to serve customers in unique and better ways. Leaders at financial institutions are overflowing with inspiration for innovative banking products and personalized experiences that can create deeper customer relationships.

Yet too many of these ideas remain on the shelf. While the list of fantastic opportunities is unending, the gap from idea to execution has been too large. Today, I’m excited to announce that Blend is narrowing that gap.

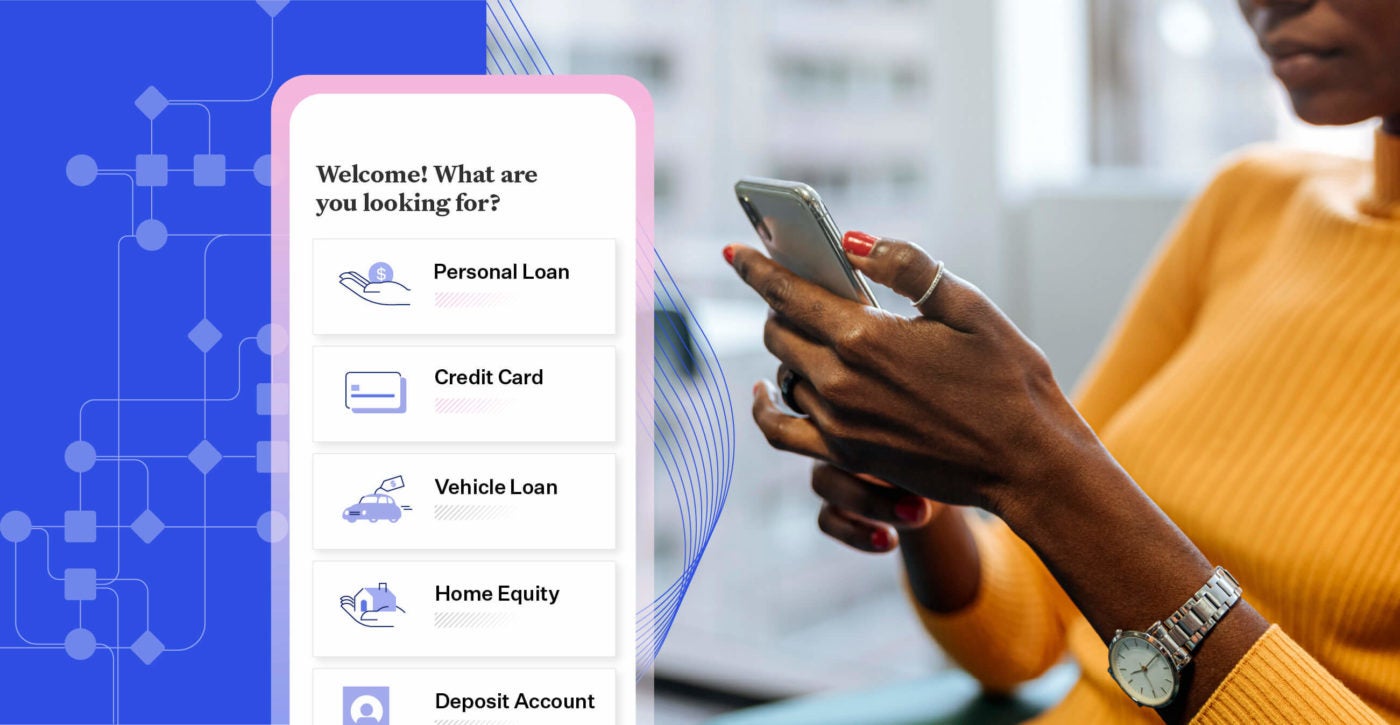

Our unified platform now supports any consumer banking product, thanks to our expanded suite of out-of-the-box offerings and new configuration capabilities. Refine your position as the go-to for your customers’ every financial need.

Announcing an expanded Consumer Banking Suite

We know many financial institutions are looking for out-of-the-box solutions that can be rapidly deployed to improve the customer experience and increase conversion rates. Unfortunately, many options on the market are one-off point solutions. While these offerings might help line of business leaders get to market quickly, they leave consumers to wade through inconsistent experiences.

With our single, unified platform, consistency in excellence can become the norm. It’s a comprehensive solution ready to rapidly deliver best-in-class lending experiences across every line of business.

We’ve added Personal Loans, Credit Cards, and Specialty Vehicle Loans to our Consumer Banking Suite, which already included offerings for Home Equity, Auto Loans, and Deposit Accounts. With this expansion, we now support every major consumer banking product commonly offered by banks and credit unions.

“With Blend’s flexible technology, we’ll be able to help our members reach their financial goals — whether it’s buying a home, purchasing a vehicle, or applying for a credit card or personal loan. With social distancing mandates in place over the last few months, some members haven’t been able to visit our branches, and we’ve seen an increase in demand for online loan applications. With Blend, we can provide the legendary service we’re known for even during these unique times.”

Justin Olson

Cheif Information Officer, UCCU

Closing the time-to-innovation gap

Although our robust out-of-the-box product offering will serve the needs of many financial institutions well, the reality is that individual circumstances often call for more tailored offerings.

Imagine one of your customers walking onto a car lot and seamlessly being served an auto pre-approval letter. Not only is it delivered right to their phone, it is personally tailored based on what you know about their financial situation.

Your customers would probably be blown away by this level of service. But how long would it take you and your team to spin up this product?

Based on what I’ve heard, the answer is “too long.” Most banks and credit unions are not set up to rapidly deliver new products or digital experiences. It simply takes too much time and effort from scarce resources to design new journeys, source component technologies, code business logic, and integrate everything with legacy systems.

What if you could reduce this time from months to days?

Introducing Blend’s new configuration capabilities

Blend has always been built on a modular architecture. Earlier this year we tapped into this when we partnered with Chris Kay and Sonny Sonnenstein at M&T Bank, who reacted quickly to the need to support the SBA PPP loan program. Together, we spun up a new product in less than four days that allowed M&T to accept nearly 10,000 loan applications in the first hour and ultimately support 718,000 employees with the financial assistance they needed.

Over the past few quarters, we’ve been working to expose more of the inherent flexibility of Blend’s platform to our lender partners. We’re combining our deep lending knowledge with the latest advances in no-code product design to enable you to deliver any consumer banking product faster.

Blend’s digital platform now includes a comprehensive component library, pre-built templates, drag-and-drop workflow building, and integrated data services. We’ve built configuration into every layer of our solution — product experiences, orchestration, data services, and third-party integrations — so you can quickly deliver products as unique as your customers.

How our unified platform enables digital agility now and in the future

Throughout 2020, I have seen lenders responding to a flurry of momentous changes: market shifts in demand driven by rate changes, consumer behavior shifts driven by social distancing mandates, and regulatory shifts, such as loan forbearance laws or the Paycheck Protection Program. This has required rapid adaptation.

Who knows what tomorrow may bring?

With our platform, you’ll now have the agility to accelerate innovation and provide the right product at the right time for your customers. As we continue to refine and broaden our capabilities, the opportunities feel endless.

Let’s return to our earlier inspiration for a new auto loan product. We imagine a future in which, with Blend, you’ll be able to develop and release it to market in a fraction of the expected time. Rather than navigating a complex development process, you’ll be free to proactively serve your customers’ every need. Imagine what else you might be able to offer:

- Offer point-of-sale term loans to help your customers save on credit card debt

- Spin up a new card to serve your small business customers better and faster

- Provide a recommendation to consolidate debt with a low-rate personal loan to a new customer when they open an account and you see they have debt on high-interest credit cards

- The sky is the limit …

Our intention is to power your business with a platform that can deliver magic moments like these across your customers’ life milestones, increasing loyalty at every interaction. Most consumers likely can’t imagine that this is even a possibility. We want to take away the friction that stands in the way of proactive service and help you offer consumers access to the financial system they deserve.

This isn’t the finish line. Our team will continue to expand the depth and breadth of the platform in the same way we continually refine our out-of-the-box products. No matter how you choose to take advantage of our platform, you can be sure you’re tapping into the best of what we have to offer. I look forward to seeing what we can build together.